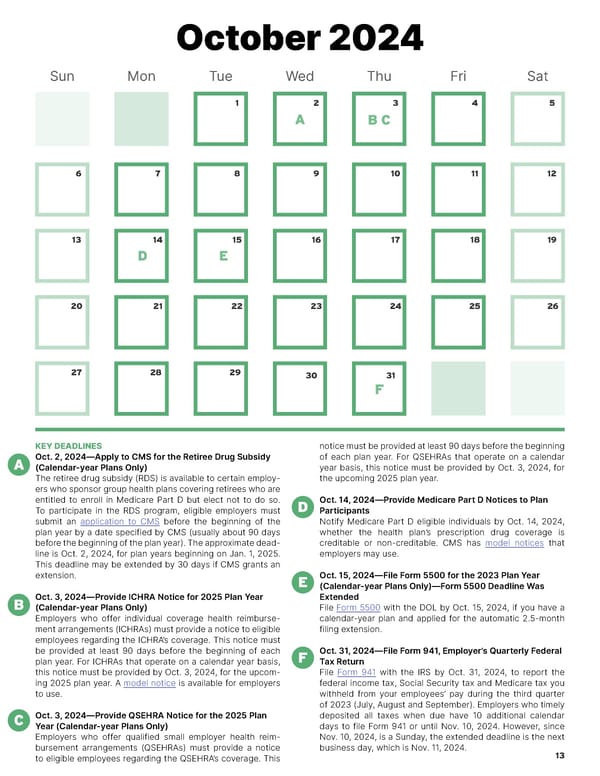

October 2024 Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 A BC 6 7 8 9 10 11 12 13 14 15 16 17 18 19 D E 20 21 22 23 24 25 26 27 28 29 30 31 F KEY DEADLINES notice must be provided at least 90 days before the beginning A Oct. 2, 2024—Apply to CMS for the Retiree Drug Subsidy of each plan year. For QSEHRAs that operate on a calendar (Calendar-year Plans Only) year basis, this notice must be provided by Oct. 3, 2024, for The retiree drug subsidy (RDS) is available to certain employ- the upcoming 2025 plan year. ers who sponsor group health plans covering retirees who are entitled to enroll in Medicare Part D but elect not to do so. D Oct. 14, 2024—Provide Medicare Part D Notices to Plan To participate in the RDS program, eligible employers must Participants submit an application to CMS before the beginning of the Notify Medicare Part D eligible individuals by Oct. 14, 2024, plan year by a date specified by CMS (usually about 90 days whether the health plan’s prescription drug coverage is before the beginning of the plan year). The approximate dead- creditable or non-creditable. CMS has model notices that line is Oct. 2, 2024, for plan years beginning on Jan. 1, 2025. employers may use. This deadline may be extended by 30 days if CMS grants an extension. E Oct. 15, 2024—File Form 5500 for the 2023 Plan Year (Calendar-year Plans Only)—Form 5500 Deadline Was B Oct. 3, 2024—Provide ICHRA Notice for 2025 Plan Year Extended (Calendar-year Plans Only) File Form 5500 with the DOL by Oct. 15, 2024, if you have a Employers who offer individual coverage health reimburse- calendar-year plan and applied for the automatic 2.5-month ment arrangements (ICHRAs) must provide a notice to eligible filing extension. employees regarding the ICHRA’s coverage. This notice must be provided at least 90 days before the beginning of each F Oct. 31, 2024—File Form 941, Employer’s Quarterly Federal plan year. For ICHRAs that operate on a calendar year basis, Tax Return this notice must be provided by Oct. 3, 2024, for the upcom- File Form 941 with the IRS by Oct. 31, 2024, to report the ing 2025 plan year. A model notice is available for employers federal income tax, Social Security tax and Medicare tax you to use. withheld from your employees’ pay during the third quarter of 2023 (July, August and September). Employers who timely C Oct. 3, 2024—Provide QSEHRA Notice for the 2025 Plan deposited all taxes when due have 10 additional calendar Year (Calendar-year Plans Only) days to file Form 941 or until Nov. 10, 2024. However, since Employers who offer qualified small employer health reim- Nov. 10, 2024, is a Sunday, the extended deadline is the next bursement arrangements (QSEHRAs) must provide a notice business day, which is Nov. 11, 2024. to eligible employees regarding the QSEHRA’s coverage. This 13

2024 HR Compliance Calendar Page 12 Page 14

2024 HR Compliance Calendar Page 12 Page 14