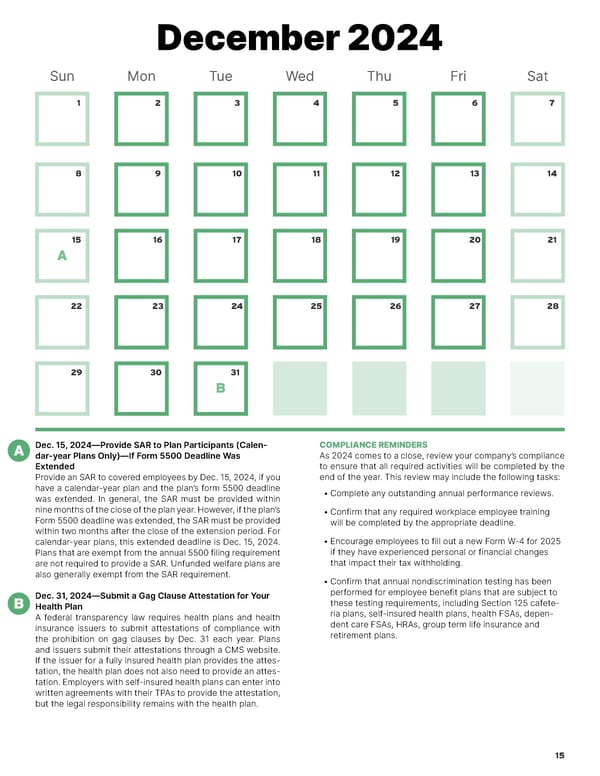

December 2024 Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 A 22 23 24 25 26 27 28 29 30 31 B A Dec. 15, 2024—Provide SAR to Plan Participants (Calen- COMPLIANCE REMINDERS dar-year Plans Only)—If Form 5500 Deadline Was As 2024 comes to a close, review your company’s compliance Extended to ensure that all required activities will be completed by the Provide an SAR to covered employees by Dec. 15, 2024, if you end of the year. This review may include the following tasks: have a calendar-year plan and the plan’s form 5500 deadline • Complete any outstanding annual performance reviews. was extended. In general, the SAR must be provided within nine months of the close of the plan year. However, if the plan’s • Confirm that any required workplace employee training Form 5500 deadline was extended, the SAR must be provided will be completed by the appropriate deadline. within two months after the close of the extension period. For calendar-year plans, this extended deadline is Dec. 15, 2024. • Encourage employees to fill out a new Form W-4 for 2025 Plans that are exempt from the annual 5500 filing requirement if they have experienced personal or financial changes are not required to provide a SAR. Unfunded welfare plans are that impact their tax withholding. also generally exempt from the SAR requirement. • Confirm that annual nondiscrimination testing has been Dec. 31, 2024—Submit a Gag Clause Attestation for Your performed for employee benefit plans that are subject to B Health Plan these testing requirements, including Section 125 cafete- A federal transparency law requires health plans and health ria plans, self-insured health plans, health FSAs, depen- insurance issuers to submit attestations of compliance with dent care FSAs, HRAs, group term life insurance and the prohibition on gag clauses by Dec. 31 each year. Plans retirement plans. and issuers submit their attestations through a CMS website. If the issuer for a fully insured health plan provides the attes- tation, the health plan does not also need to provide an attes- tation. Employers with self-insured health plans can enter into written agreements with their TPAs to provide the attestation, but the legal responsibility remains with the health plan. 15

2024 HR Compliance Calendar Page 14 Page 16

2024 HR Compliance Calendar Page 14 Page 16