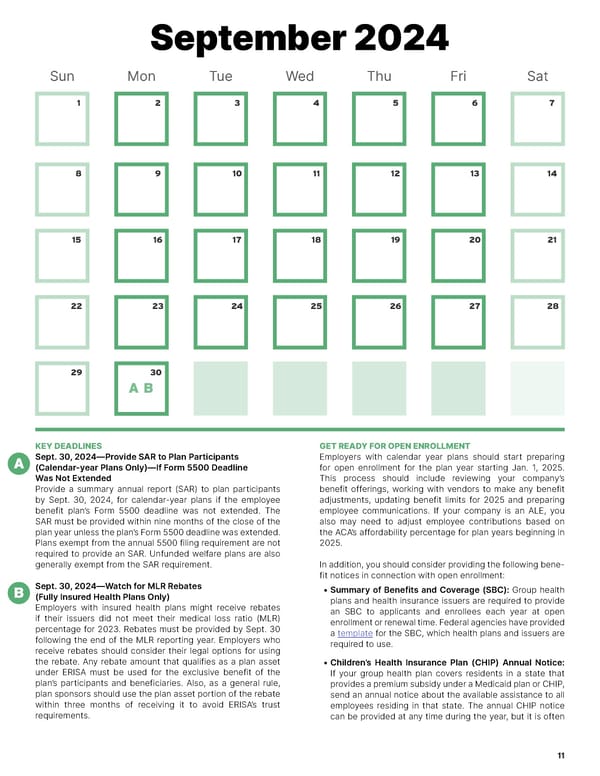

September 2024 Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 AB KEY DEADLINES GET READY FOR OPEN ENROLLMENT A Sept. 30, 2024—Provide SAR to Plan Participants Employers with calendar year plans should start preparing (Calendar-year Plans Only)—If Form 5500 Deadline for open enrollment for the plan year starting Jan. 1, 2025. Was Not Extended This process should include reviewing your company’s Provide a summary annual report (SAR) to plan participants benefit offerings, working with vendors to make any benefit by Sept. 30, 2024, for calendar-year plans if the employee adjustments, updating benefit limits for 2025 and preparing benefit plan’s Form 5500 deadline was not extended. The employee communications. If your company is an ALE, you SAR must be provided within nine months of the close of the also may need to adjust employee contributions based on plan year unless the plan’s Form 5500 deadline was extended. the ACA’s affordability percentage for plan years beginning in Plans exempt from the annual 5500 filing requirement are not 2025. required to provide an SAR. Unfunded welfare plans are also generally exempt from the SAR requirement. In addition, you should consider providing the following bene- fit notices in connection with open enrollment: B Sept. 30, 2024—Watch for MLR Rebates • Summary of Benefits and Coverage (SBC): Group health (Fully Insured Health Plans Only) plans and health insurance issuers are required to provide Employers with insured health plans might receive rebates an SBC to applicants and enrollees each year at open if their issuers did not meet their medical loss ratio (MLR) enrollment or renewal time. Federal agencies have provided percentage for 2023. Rebates must be provided by Sept. 30 a template for the SBC, which health plans and issuers are following the end of the MLR reporting year. Employers who required to use. receive rebates should consider their legal options for using the rebate. Any rebate amount that qualifies as a plan asset • Children’s Health Insurance Plan (CHIP) Annual Notice: under ERISA must be used for the exclusive benefit of the If your group health plan covers residents in a state that plan’s participants and beneficiaries. Also, as a general rule, provides a premium subsidy under a Medicaid plan or CHIP, plan sponsors should use the plan asset portion of the rebate send an annual notice about the available assistance to all within three months of receiving it to avoid ERISA’s trust employees residing in that state. The annual CHIP notice requirements. can be provided at any time during the year, but it is often 11

2024 HR Compliance Calendar Page 10 Page 12

2024 HR Compliance Calendar Page 10 Page 12