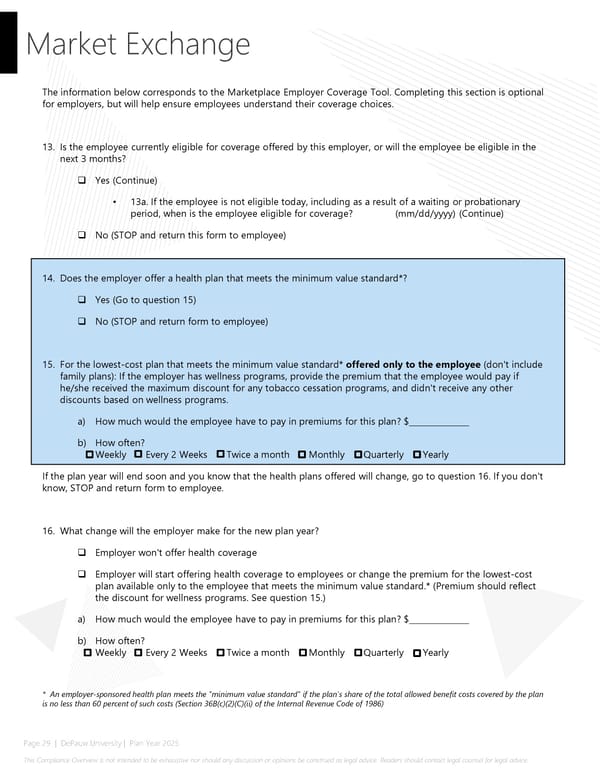

Market Exchange The information below corresponds to the Marketplace Employer Coverage Tool. Completing this section is optional for employers, but will help ensure employees understand their coverage choices. 13. Is the employee currently eligible for coverage offered by this employer, or will the employee be eligible in the next 3 months? Yes (Continue) • 13a. If the employee is not eligible today, including as a result of a waiting or probationary period, when is the employee eligible for coverage? (mm/dd/yyyy) (Continue) No (STOP and return this form to employee) 14. Does the employer offer a health plan that meets the minimum value standard*? Yes (Go to question 15) No (STOP and return form to employee) 15. For the lowest-cost plan that meets the minimum value standard* offered only to the employee (don't include family plans): If the employer has wellness programs, provide the premium that the employee would pay if he/she received the maximum discount for any tobacco cessation programs, and didn't receive any other discounts based on wellness programs. a) How much would the employee have to pay in premiums for this plan? $_______________ b) How often? Weekly Every 2 Weeks Twice a month Monthly Quarterly Yearly If the plan year will end soon and you know that the health plans offered will change, go to question 16. If you don't know, STOP and return form to employee. 16. What change will the employer make for the new plan year? Employer won't offer health coverage Employer will start offering health coverage to employees or change the premium for the lowest-cost plan available only to the employee that meets the minimum value standard.* (Premium should reflect the discount for wellness programs. See question 15.) a) How much would the employee have to pay in premiums for this plan? $_______________ b) How often? Weekly Every 2 Weeks Twice a month Monthly Quarterly Yearly * An employer-sponsored health plan meets the "minimum value standard" if the plan's share of the total allowed benefit costs covered by the plan is no less than 60 percent of such costs (Section 36B(c)(2)(C)(ii) of the Internal Revenue Code of 1986) Page 29 | DePauw University | Plan Year 2025 This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

2025 DePauw Compliance Bundle Page 28 Page 30

2025 DePauw Compliance Bundle Page 28 Page 30