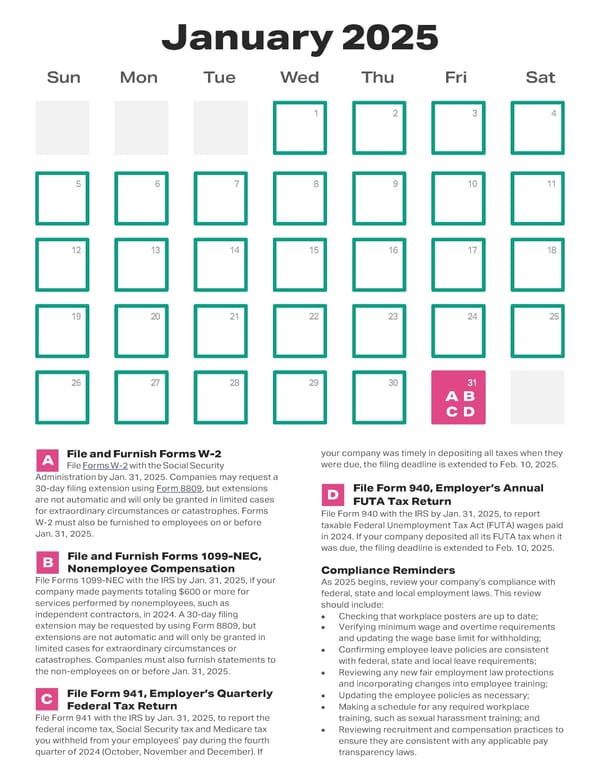

January 2025 Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 A B C D A File and Furnish Forms W-2 your company was timely in depositing all taxes when they File Forms W-2 with the Social Security were due, the filing deadline is extended to Feb. 10, 2025. Administration by Jan. 31, 2025. Companies may request a 30-day filing extension using Form 8809, but extensions D File Form 940, Employer’s Annual are not automatic and will only be granted in limited cases FUTA Tax Return for extraordinary circumstances or catastrophes. Forms W-2 must also be furnished to employees on or before File Form 940 with the IRS by Jan. 31, 2025, to report Jan. 31, 2025. taxable Federal Unemployment Tax Act (FUTA) wages paid in 2024. If your company deposited all its FUTA tax when it File and Furnish Forms 1099-NEC, was due, the filing deadline is extended to Feb. 10, 2025. B Nonemployee Compensation File Forms 1099-NEC with the IRS by Jan. 31, 2025, if your Compliance Reminders company made payments totaling $600 or more for As 2025 begins, review your company’s compliance with services performed by nonemployees, such as federal, state and local employment laws. This review independent contractors, in 2024. A 30-day filing should include: extension may be requested by using Form 8809, but • Checking that workplace posters are up to date; extensions are not automatic and will only be granted in • Verifying minimum wage and overtime requirements limited cases for extraordinary circumstances or and updating the wage base limit for withholding; catastrophes. Companies must also furnish statements to • Confirming employee leave policies are consistent the non-employees on or before Jan. 31, 2025. with federal, state and local leave requirements; • Reviewing any new fair employment law protections File Form 941, Employer’s Quarterly and incorporating changes into employee training; C Federal Tax Return • Updating the employee policies as necessary; File Form 941 with the IRS by Jan. 31, 2025, to report the • Making a schedule for any required workplace federal income tax, Social Security tax and Medicare tax training, such as sexual harassment training; and you withheld from your employees’ pay during the fourth • Reviewing recruitment and compensation practices to quarter of 2024 (October, November and December). If ensure they are consistent with any applicable pay transparency laws.

2025 HR Compliance Calendar Page 1 Page 3

2025 HR Compliance Calendar Page 1 Page 3