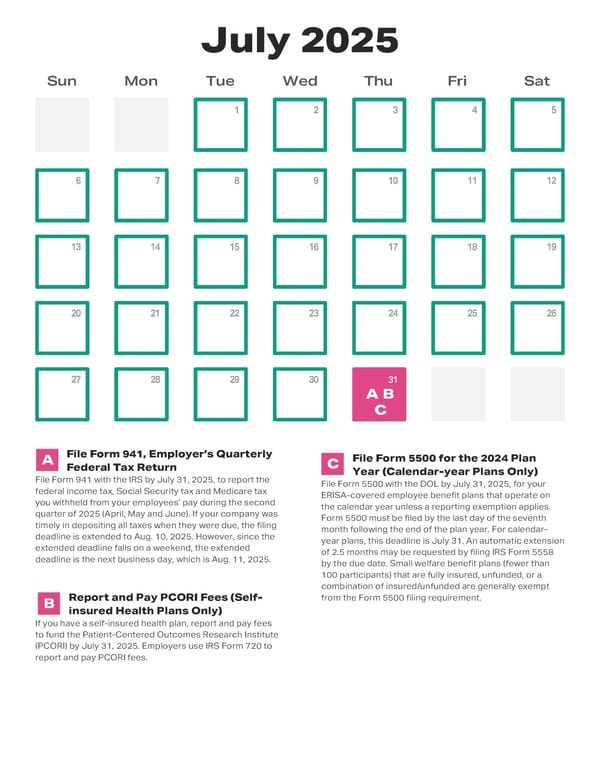

July 2025 Sun Mon Tue Wed Thu Fri Sat 31 A B C A File Form 941, Employer’s Quarterly C File Form 5500 for the 2024 Plan Federal Tax Return Year (Calendar-year Plans Only) File Form 941 with the IRS by July 31, 2025, to report the File Form 5500 with the DOL by July 31, 2025, for your federal income tax, Social Security tax and Medicare tax ERISA-covered employee benefit plans that operate on you withheld from your employees’ pay during the second the calendar year unless a reporting exemption applies. quarter of 2025 (April, May and June). If your company was Form 5500 must be filed by the last day of the seventh timely in depositing all taxes when they were due, the filing month following the end of the plan year. For calendar- deadline is extended to Aug. 10, 2025. However, since the year plans, this deadline is July 31. An automatic extension extended deadline falls on a weekend, the extended of 2.5 months may be requested by filing IRS Form 5558 deadline is the next business day, which is Aug. 11, 2025. by the due date. Small welfare benefit plans (fewer than 100 participants) that are fully insured, unfunded, or a combination of insured/unfunded are generally exempt B Report and Pay PCORI Fees (Self- from the Form 5500 filing requirement. insured Health Plans Only) If you have a self-insured health plan, report and pay fees to fund the Patient-Centered Outcomes Research Institute (PCORI) by July 31, 2025. Employers use IRS Form 720 to report and pay PCORI fees.

2025 HR Compliance Calendar Page 8 Page 10

2025 HR Compliance Calendar Page 8 Page 10