****Class Only Model Document ***

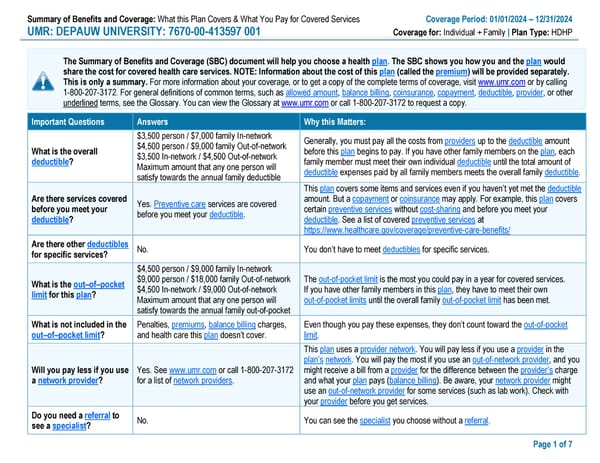

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: 01/01/2024 – 12/31/2024 UMR: DEPAUW UNIVERSITY: 7670-00-413597 001 Coverage for: Individual + Family | Plan Type: HDHP The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.umr.com or by calling 1-800-207-3172. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms, see the Glossary. You can view the Glossary at www.umr.com or call 1-800-207-3172 to request a copy. Important Questions Answers Why this Matters: $3,500 person / $7,000 family In-network Generally, you must pay all the costs from providers up to the deductible amount What is the overall $4,500 person / $9,000 family Out-of-network before this plan begins to pay. If you have other family members on the plan, each deductible? $3,500 In-network / $4,500 Out-of-network family member must meet their own individual deductible until the total amount of Maximum amount that any one person will deductible expenses paid by all family members meets the overall family deductible. satisfy towards the annual family deductible This plan covers some items and services even if you haven’t yet met the deductible Are there services covered Yes. Preventive care services are covered amount. But a copayment or coinsurance may apply. For example, this plan covers before you meet your before you meet your deductible. certain preventive services without cost-sharing and before you meet your deductible? deductible. See a list of covered preventive services at https://www.healthcare.gov/coverage/preventive-care-benefits/ Are there other deductibles No. You don’t have to meet deductibles for specific services. for specific services? $4,500 person / $9,000 family In-network What is the out–of–pocket $9,000 person / $18,000 family Out-of-network The out-of-pocket limit is the most you could pay in a year for covered services. limit for this plan? $4,500 In-network / $9,000 Out-of-network If you have other family members in this plan, they have to meet their own Maximum amount that any one person will out-of-pocket limits until the overall family out-of-pocket limit has been met. satisfy towards the annual family out-of-pocket What is not included in the Penalties, premiums, balance billing charges, Even though you pay these expenses, they don’t count toward the out-of-pocket out–of–pocket limit? and health care this plan doesn’t cover. limit. This plan uses a provider network. You will pay less if you use a provider in the plan’s network. You will pay the most if you use an out-of-network provider, and you Will you pay less if you use Yes. See www.umr.com or call 1-800-207-3172 might receive a bill from a provider for the difference between the provider’s charge a network provider? for a list of network providers. and what your plan pays (balance billing). Be aware, your network provider might use an out-of-network provider for some services (such as lab work). Check with your provider before you get services. Do you need a referral to No. You can see the specialist you choose without a referral. see a specialist? Page 1 of 7

****Class Only Model Document *** Page 2

****Class Only Model Document *** Page 2