Critical Illness Insurance Overview

This document provides an overview of New York Life Group Benefit Solutions' Critical Illness Insurance, detailing eligibility, coverage amounts, and conditions covered in the plan.

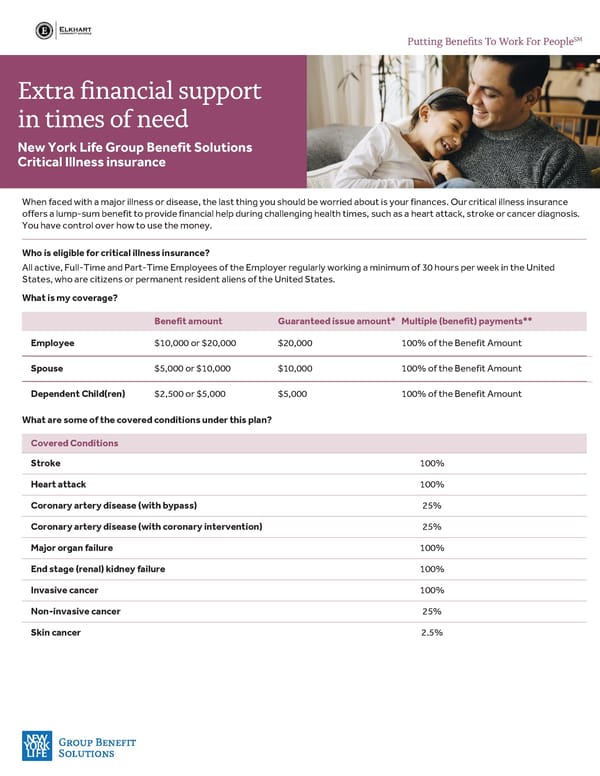

SM Putting Bene昀椀ts To Work For People Extra financial support in times of need New York Life Group Benefit Solutions Critical Illness insurance When faced with a major illness or disease, the last thing you should be worried about is your finances. Our critical illness insurance offers a lump-sum benefit to provide financial help during challenging health times, such as a heart attack, stroke or cancer diagnosis. You have control over how to use the money. Who is eligible for critical illness insurance? All active, Full-Time and Part-Time Employees of the Employer regularly working a minimum of 30 hours per week in the United States, who are citizens or permanent resident aliens of the United States. What is my coverage? Benefit amount Guaranteed issue amount* Multiple (benefit) payments** Employee $10,000 or $20,000 $20,000 100% of the Benefit Amount Spouse $5,000 or $10,000 $10,000 100% of the Benefit Amount Dependent Child(ren) $2,500 or $5,000 $5,000 100% of the Benefit Amount What are some of the covered conditions under this plan? Covered Conditions Stroke 100% Heart attack 100% Coronary artery disease (with bypass) 25% Coronary artery disease (with coronary intervention) 25% Major organ failure 100% End stage (renal) kidney failure 100% Invasive cancer 100% Non-invasive cancer 25% Skin cancer 2.5%

Critical Illness Insurance Overview Page 2

Critical Illness Insurance Overview Page 2