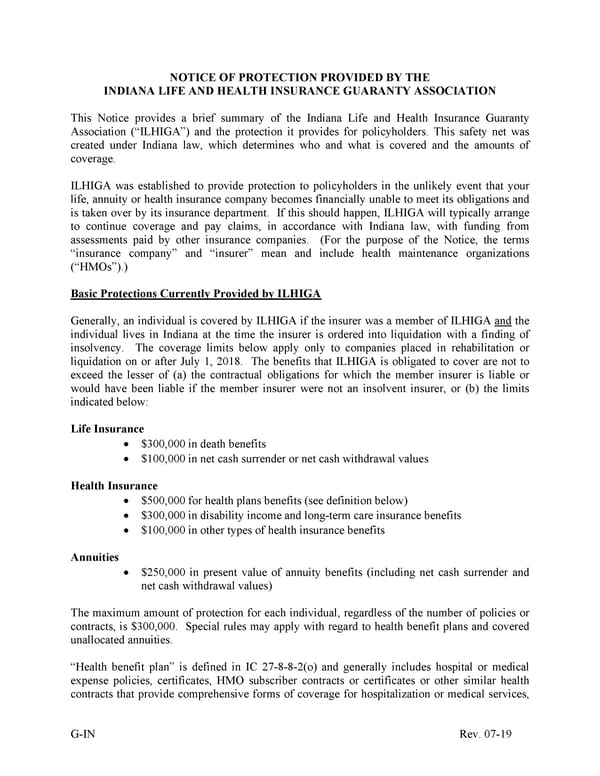

G-IN Rev. 07-19 NOTICE OF PROTECTION PROVIDED BY THE INDIANA LIFE AND HEALTH INSURANCE GUARANTY ASSOCIATION This Notice provides a brief summary of the Indiana Life and Health Insurance Guaranty Association (“ILHIGA”) and the protection it provides for policyholders. This safety net was created under Indiana law, which determines who and what is covered and the amounts of coverage. ILHIGA was established to provide protection to policyholders in the unlikely event that your life, annuity or health insurance company becomes financially unable to meet its obligations and is taken over by its insurance department. If this should happen, ILHIGA will typically arrange to continue coverage and pay claims, in accordance with Indiana law, with funding from assessments paid by other insurance companies. (For the purpose of the Notice, the terms “insurance company” and “insurer” mean and include health maintenance organizations (“HMOs”).) Basic Protections Currently Provided by ILHIGA Generally, an individual is covered by ILHIGA if the insurer was a member of ILHIGA and the individual lives in Indiana at the time the insurer is ordered into liquidation with a finding of insolvency. The coverage limits below apply only to companies placed in rehabilitation or liquidation on or after July 1, 2018. The benefits that ILHIGA is obligated to cover are not to exceed the lesser of (a) the contractual obligations for which the member insurer is liable or would have been liable if the member insurer were not an insolvent insurer, or (b) the limits indicated below: Life Insurance · $300,000 in death benefits · $100,000 in net cash surrender or net cash withdrawal values Health Insurance · $500,000 for health plans benefits (see definition below) · $300,000 in disability income and long-term care insurance benefits · $100,000 in other types of health insurance benefits Annuities · $250,000 in present value of annuity benefits (including net cash surrender and net cash withdrawal values) The maximum amount of protection for each individual, regardless of the number of policies or contracts, is $300,000. Special rules may apply with regard to health benefit plans and covered unallocated annuities. “Health benefit plan” is defined in IC 27-8-8-2(o) and generally includes hospital or medical expense policies, certificates, HMO subscriber contracts or certificates or other similar health contracts that provide comprehensive forms of coverage for hospitalization or medical services,

Certificate of Insurance for Group Long Term Disability Income Insurance Page 51 Page 53

Certificate of Insurance for Group Long Term Disability Income Insurance Page 51 Page 53