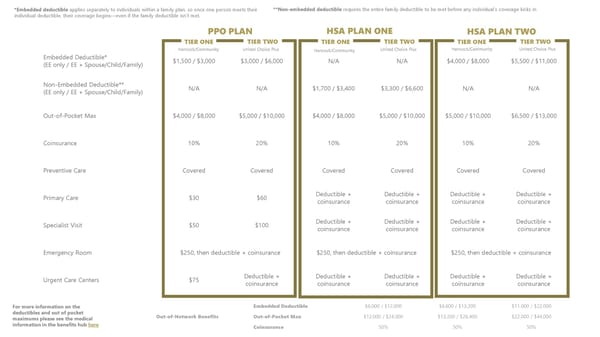

Embedded Deductible* (EE only / EE + Spouse/Child/Family) $1,500 / $3,000 $3,000 / $6,000 N/A N/A $4,000 / $8,000 $5,500 / $11,000 Non-Embedded Deductible** (EE only / EE + Spouse/Child/Family) N/A N/A $1,700 / $3,400 $3,300 / $6,600 N/A N/A Out-of-Pocket Max $4,000 / $8,000 $5,000 / $10,000 $4,000 / $8,000 $5,000 / $10,000 $5,000 / $10,000 $6,500 / $13,000 Coinsurance 10% 20% 10% 20% 10% 20% Preventive Care Covered Covered Covered Covered Covered Covered Primary Care $30 $60 Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Specialist Visit $50 $100 Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Emergency Room $250, then deductible + coinsurance $250, then deductible + coinsurance $250, then deductible + coinsurance Urgent Care Centers $75 Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance PPO PLAN TIER ONE TIER TWO HSA PLAN ONE TIER ONE TIER TWO HSA PLAN TWO TIER ONE TIER TWO Out-of-Network Benefits Embedded Deductible $6,000 / $12,000 $6,600 / $13,200 $11,000 / $22,000 Out-of-Pocket Max $12,000 / $24,000 $13,200 / $26,400 $22,000 / $44,000 Coinsurance 50% 50% 50% *Embedded deductible applies separately to individuals within a family plan, so once one person meets their individual deductible, their coverage begins—even if the family deductible isn't met. For more information on the deductibles and out of pocket maximums please see the medical information in the benefits hub here Hancock/Community United Choice Plus United Choice Plus United Choice Plus Hancock/Community Hancock/Community **Non-embedded deductible requires the entire family deductible to be met before any individual’s coverage kicks in

Mt. Vernon Employee Benefits Package 2026 Page 6 Page 8

Mt. Vernon Employee Benefits Package 2026 Page 6 Page 8