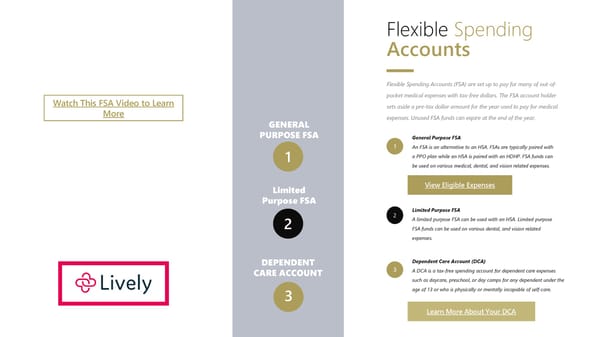

GENERAL PURPOSE FSA DEPENDENT CARE ACCOUNT Flexible Spending Accounts Flexible Spending Accounts (FSA) are set up to pay for many of out-of- pocket medical expenses with tax-free dollars. The FSA account holder sets aside a pre-tax dollar amount for the year used to pay for medical expenses. Unused FSA funds can expire at the end of the year. 1 General Purpose FSA An FSA is an alternative to an HSA. FSAs are typically paired with a PPO plan while an HSA is paired with an HDHP. FSA funds can be used on various medical, dental, and vision related expenses. 2 Watch This FSA Video to Learn More 1 2 View Eligible Expenses Learn More About Your DCA 2 3 Limited Purpose FSA A limited purpose FSA can be used with an HSA. Limited purpose FSA funds can be used on various dental, and vision related expenses. Dependent Care Account (DCA) A DCA is a tax-free spending account for dependent care expenses such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. 3 Limited Purpose FSA

Mt. Vernon Community School Corporation Benefit Guide Page 19 Page 21

Mt. Vernon Community School Corporation Benefit Guide Page 19 Page 21