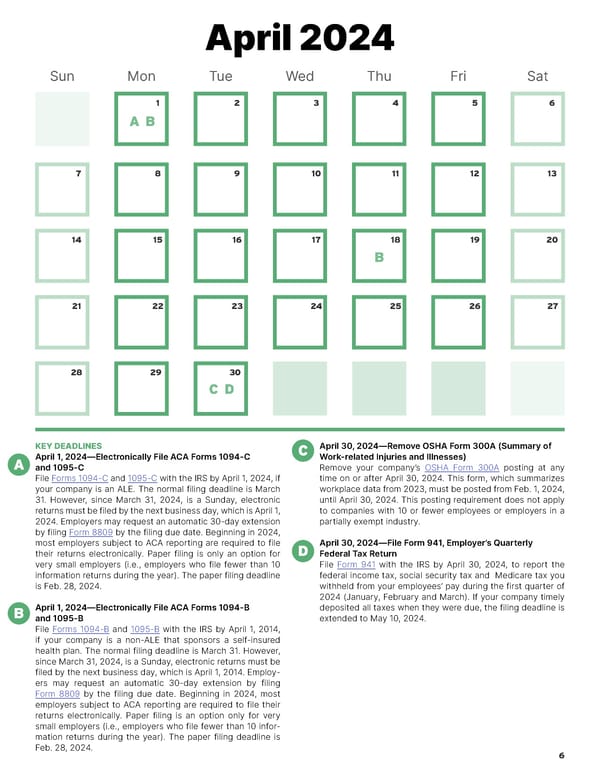

April 2024 Sun Mon Tue Wed Thu Fri Sat 1 2 3 4 5 6 A B 7 8 9 10 11 12 13 14 15 16 17 18 19 20 B 21 22 23 24 25 26 27 28 29 30 C D KEY DEADLINES C April 30, 2024—Remove OSHA Form 300A (Summary of A April 1, 2024—Electronically File ACA Forms 1094-C Work-related Injuries and Illnesses) and 1095-C Remove your company’s OSHA Form 300A posting at any File Forms 1094-C and 1095-C with the IRS by April 1, 2024, if time on or after April 30, 2024. This form, which summarizes your company is an ALE. The normal filing deadline is March workplace data from 2023, must be posted from Feb. 1, 2024, 31. However, since March 31, 2024, is a Sunday, electronic until April 30, 2024. This posting requirement does not apply returns must be filed by the next business day, which is April 1, to companies with 10 or fewer employees or employers in a 2024. Employers may request an automatic 30-day extension partially exempt industry. by filing Form 8809 by the filing due date. Beginning in 2024, most employers subject to ACA reporting are required to file D April 30, 2024—File Form 941, Employer’s Quarterly their returns electronically. Paper filing is only an option for Federal Tax Return very small employers (i.e., employers who file fewer than 10 File Form 941 with the IRS by April 30, 2024, to report the information returns during the year). The paper filing deadline federal income tax, social security tax and Medicare tax you is Feb. 28, 2024. withheld from your employees’ pay during the first quarter of 2024 (January, February and March). If your company timely B April 1, 2024—Electronically File ACA Forms 1094-B deposited all taxes when they were due, the filing deadline is and 1095-B extended to May 10, 2024. File Forms 1094-B and 1095-B with the IRS by April 1, 2014, if your company is a non-ALE that sponsors a self-insured health plan. The normal filing deadline is March 31. However, since March 31, 2024, is a Sunday, electronic returns must be filed by the next business day, which is April 1, 2014. Employ- ers may request an automatic 30-day extension by filing Form 8809 by the filing due date. Beginning in 2024, most employers subject to ACA reporting are required to file their returns electronically. Paper filing is an option only for very small employers (i.e., employers who file fewer than 10 infor- mation returns during the year). The paper filing deadline is Feb. 28, 2024. 6

2024 HR Compliance Calendar Page 5 Page 7

2024 HR Compliance Calendar Page 5 Page 7