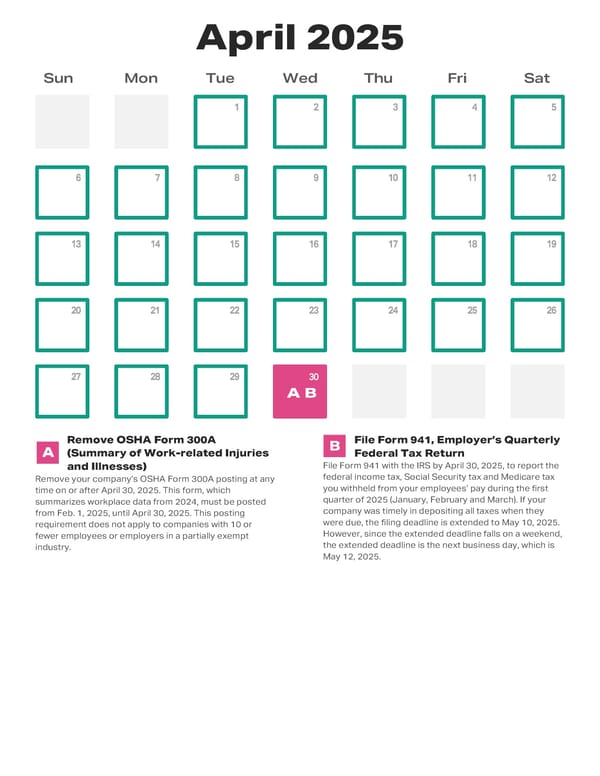

April 2025 Sun Mon Tue Wed Thu Fri Sat 30 A B Remove OSHA Form 300A B File Form 941, Employer’s Quarterly A (Summary of Work-related Injuries Federal Tax Return and Illnesses) File Form 941 with the IRS by April 30, 2025, to report the Remove your company’s OSHA Form 300A posting at any federal income tax, Social Security tax and Medicare tax time on or after April 30, 2025. This form, which you withheld from your employees’ pay during the first summarizes workplace data from 2024, must be posted quarter of 2025 (January, February and March). If your from Feb. 1, 2025, until April 30, 2025. This posting company was timely in depositing all taxes when they requirement does not apply to companies with 10 or were due, the filing deadline is extended to May 10, 2025. fewer employees or employers in a partially exempt However, since the extended deadline falls on a weekend, industry. the extended deadline is the next business day, which is May 12, 2025.

2025 HR Compliance Calendar Page 5 Page 7

2025 HR Compliance Calendar Page 5 Page 7