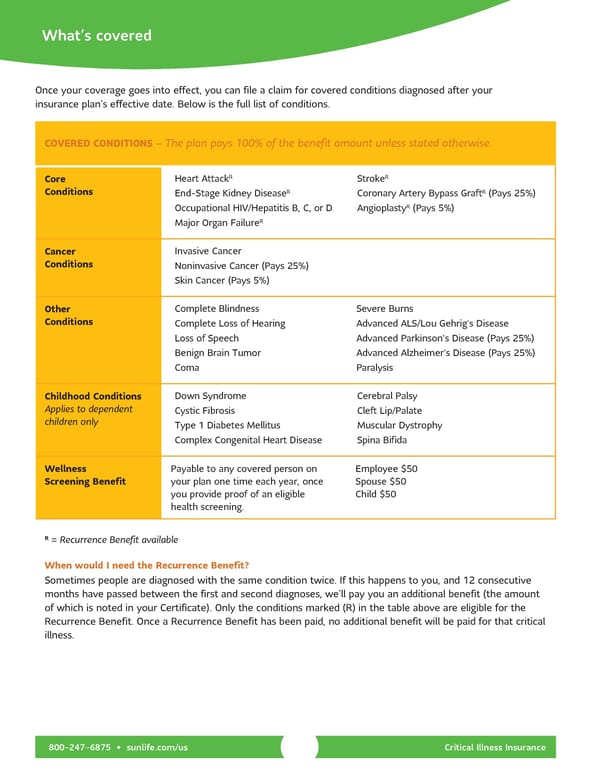

What’s covered Once your coverage goes into effect, you can file a claim for covered conditions diagnosed after your insurance plan’s effective date. Below is the full list of conditions. COVERED CONDITIONS – The plan pays 100% of the benefit amount unless stated otherwise. R R Core Heart Attack Stroke Conditions R R End-Stage Kidney Disease Coronary Artery Bypass Graft (Pays 25%) R Occupational HIV/Hepatitis B, C, or D Angioplasty (Pays 5%) R Major Organ Failure Cancer Invasive Cancer Conditions Noninvasive Cancer (Pays 25%) Skin Cancer (Pays 5%) Other Complete Blindness Severe Burns Conditions Complete Loss of Hearing Advanced ALS/Lou Gehrig's Disease Loss of Speech Advanced Parkinson's Disease (Pays 25%) Benign Brain Tumor Advanced Alzheimer's Disease (Pays 25%) Coma Paralysis Childhood Conditions Down Syndrome Cerebral Palsy Applies to dependent Cystic Fibrosis Cleft Lip/Palate children only Type 1 Diabetes Mellitus Muscular Dystrophy Complex Congenital Heart Disease Spina Bifida Wellness Payable to any covered person on Employee $50 Screening Benefit your plan one time each year, once Spouse $50 you provide proof of an eligible Child $50 health screening. R = Recurrence Benefit available When would I need the Recurrence Benefit? Sometimes people are diagnosed with the same condition twice. If this happens to you, and 12 consecutive months have passed between the first and second diagnoses, we’ll pay you an additional benefit (the amount of which is noted in your Certificate). Only the conditions marked (R) in the table above are eligible for the Recurrence Benefit. Once a Recurrence Benefit has been paid, no additional benefit will be paid for that critical illness. 800-247-6875 • sunlife.com/us Critical Illness Insurance

917800 Critical Illness (12) 01.01.2024 Page 1 Page 3

917800 Critical Illness (12) 01.01.2024 Page 1 Page 3