917800 Critical Illness (12) 01.01.2024

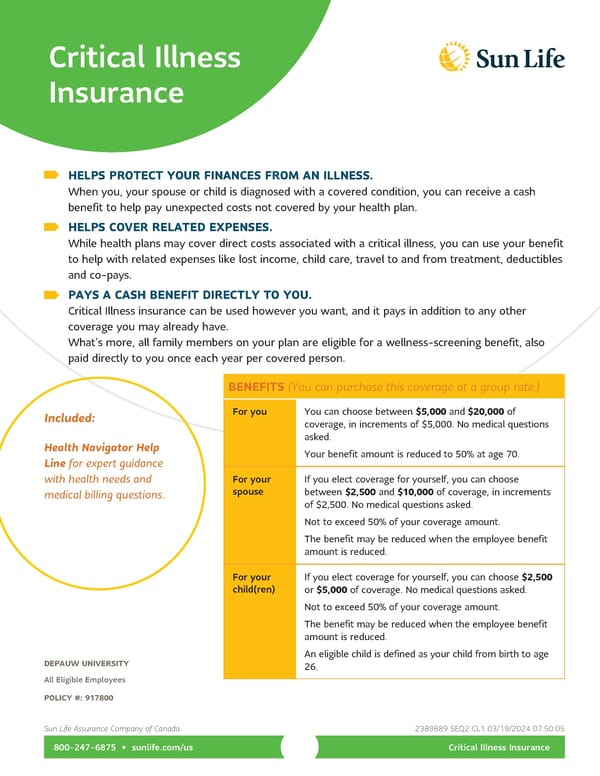

Critical Illness Insurance Y HELPS PROTECT YOUR FINANCES FROM AN ILLNESS. When you, your spouse or child is diagnosed with a covered condition, you can receive a cash benefit to help pay unexpected costs not covered by your health plan. HELPS COVER RELATED EXPENSES. While health plans may cover direct costs associated with a critical illness, you can use your benefit to help with related expenses like lost income, child care, travel to and from treatment, deductibles and co-pays. PAYS A CASH BENEFIT DIRECTLY TO YOU. Critical Illness insurance can be used however you want, and it pays in addition to any other coverage you may already have. What’s more, all family members on your plan are eligible for a wellness-screening benefit, also paid directly to you once each year per covered person. BENEFITS (You can purchase this coverage at a group rate.) Included: For you You can choose between $5,000 and $20,000 of coverage, in increments of $5,000. No medical questions asked. Health Navigator Help Your benefit amount is reduced to 50% at age 70. Line for expert guidance with health needs and For your If you elect coverage for yourself, you can choose medical billing questions. spouse between $2,500 and $10,000 of coverage, in increments of $2,500. No medical questions asked. Not to exceed 50% of your coverage amount. The benefit may be reduced when the employee benefit amount is reduced. For your If you elect coverage for yourself, you can choose $2,500 child(ren) or $5,000 of coverage. No medical questions asked. Not to exceed 50% of your coverage amount. The benefit may be reduced when the employee benefit amount is reduced. An eligible child is defined as your child from birth to age DEPAUW UNIVERSITY 26. All Eligible Employees POLICY #: 917800 Sun Life Assurance Company of Canada 2389889 SEQ2 CL1 03/19/2024 07:50:05 800-247-6875 • sunlife.com/us Critical Illness Insurance

917800 Critical Illness (12) 01.01.2024 Page 2

917800 Critical Illness (12) 01.01.2024 Page 2