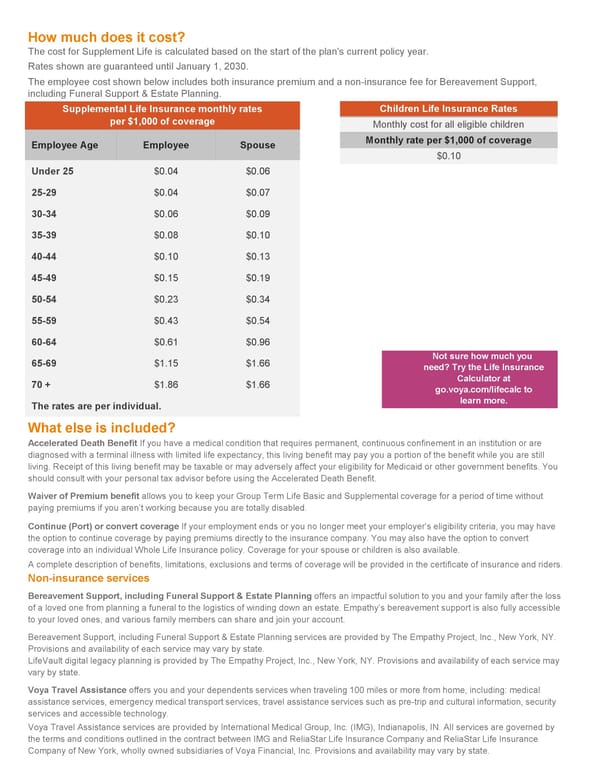

The cost for Supplement Life is calculated based on the start of the plan's current policy year. Rates shown are guaranteed until January 1, 2030. The employee cost shown below includes both insurance premium and a non-insurance fee for Bereavement Support, including Funeral Support & Estate Planning. How much does it cost? What else is included? Accelerated Death Benefit If you have a medical condition that requires permanent, continuous confinement in an institution or are diagnosed with a terminal illness with limited life expectancy, this living benefit may pay you a portion of the benefit while you are still living. Receipt of this living benefit may be taxable or may adversely affect your eligibility for Medicaid or other government benefits. You should consult with your personal tax advisor before using the Accelerated Death Benefit. Waiver of Premium benefit allows you to keep your Group Term Life Basic and Supplemental coverage for a period of time without paying premiums if you arent working because you are totally disabled. Continue (Port) or convert coverage If your employment ends or you no longer meet your employers eligibility criteria, you may have the option to continue coverage by paying premiums directly to the insurance company. You may also have the option to convert coverage into an individual Whole Life Insurance policy. Coverage for your spouse or children is also available. A complete description of benefits, limitations, exclusions and terms of coverage will be provided in the certificate of insurance and riders. Non-insurance services Bereavement Support, including Funeral Support & Estate Planning offers an impactful solution to you and your family after the loss of a loved one from planning a funeral to the logistics of winding down an estate. Empathys bereavement support is also fully accessible to your loved ones, and various family members can share and join your account. Bereavement Support, including Funeral Support & Estate Planning services are provided by The Empathy Project, Inc., New York, NY. Provisions and availability of each service may vary by state. LifeVault digital legacy planning is provided by The Empathy Project, Inc., New York, NY. Provisions and availability of each service may vary by state. Voya Travel Assistance offers you and your dependents services when traveling 100 miles or more from home, including: medical assistance services, emergency medical transport services, travel assistance services such as pre-trip and cultural information, security services and accessible technology. Voya Travel Assistance services are provided by International Medical Group, Inc. (IMG), Indianapolis, IN. All services are governed by the terms and conditions outlined in the contract between IMG and ReliaStar Life Insurance Company and ReliaStar Life Insurance Company of New York, wholly owned subsidiaries of Voya Financial, Inc. Provisions and availability may vary by state. Not sure how much you need? Try the Life Insurance Calculator at go.voya.com/lifecalc to learn more. Supplemental Life Insurance monthly rates per $1,000 of coverage Employee Age Employee Spouse Under 25 $0.04 $0.06 25-29 $0.04 $0.07 30-34 $0.06 $0.09 35-39 $0.08 $0.10 40-44 $0.10 $0.13 45-49 $0.15 $0.19 50-54 $0.23 $0.34 55-59 $0.43 $0.54 60-64 $0.61 $0.96 65-69 $1.15 $1.66 70 + $1.86 $1.66 The rates are per individual. Children Life Insurance Rates Monthly cost for all eligible children Monthly rate per $1,000 of coverage $0.10

Group Term Life Page 1 Page 3

Group Term Life Page 1 Page 3