Group Term Life

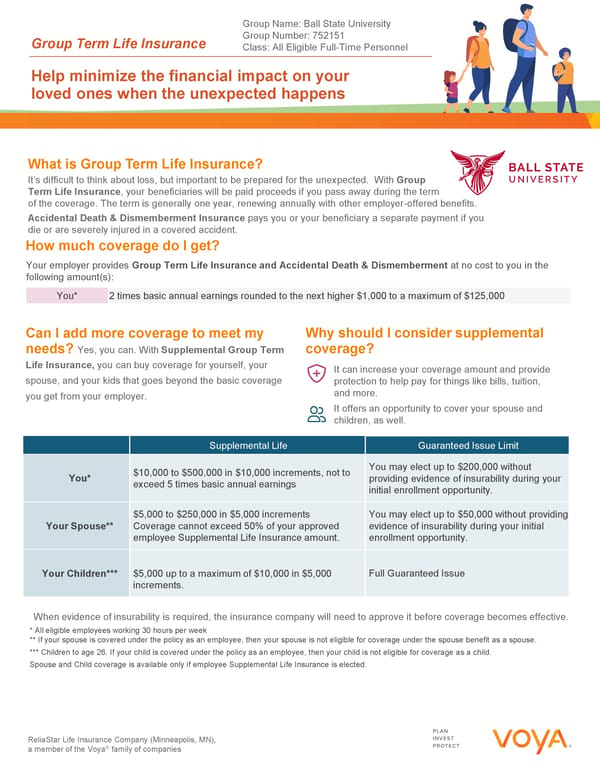

ReliaStar Life Insurance Company (Minneapolis, MN), a member of the Voya family of companies Group Term Life Insurance What is Group Term Life Insurance? Its difficult to think about loss, but important to be prepared for the unexpected. With Group Term Life Insurance , your beneficiaries will be paid proceeds if you pass away during the term of the coverage. The term is generally one year, renewing annually with other employer-offered benefits. Accidental Death & Dismemberment Insurance pays you or your beneficiary a separate payment if you die or are severely injured in a covered accident. Supplemental Life Guaranteed Issue Limit You* $10,000 to $500,000 in $10,000 increments, not to exceed 5 times basic annual earnings You may elect up to $200,000 without providing evidence of insurability during your initial enrollment opportunity. Your Spouse** $5,000 to $250,000 in $5,000 increments Coverage cannot exceed 50% of your approved employee Supplemental Life Insurance amount. You may elect up to $50,000 without providing evidence of insurability during your initial enrollment opportunity. Your Children*** $5,000 up to a maximum of $10,000 in $5,000 increments. Full Guaranteed Issue Group Name: Ball State University Group Number: 752151 Class: All Eligible Full-Time Personnel How much coverage do I get? Help minimize the financial impact on your loved ones when the unexpected happens Why should I consider supplemental coverage? It can increase your coverage amount and provide protection to help pay for things like bills, tuition, and more. It offers an opportunity to cover your spouse and children, as well. When evidence of insurability is required, the insurance company will need to approve it before coverage becomes effective. Can I add more coverage to meet my needs? Yes, you can. With Supplemental Group Term Life Insurance, you can buy coverage for yourself, your spouse, and your kids that goes beyond the basic coverage you get from your employer. Your employer provides Group Term Life Insurance and Accidental Death & Dismemberment at no cost to you in the following amount(s): You* 2 times basic annual earnings rounded to the next higher $1,000 to a maximum of $125,000 * All eligible employees working 30 hours per week ** If your spouse is covered under the policy as an employee, then your spouse is not eligible for coverage under the spouse benefit as a spouse. *** Children to age 26. If your child is covered under the policy as an employee, then your child is not eligible for coverage as a child. Spouse and Child coverage is available only if employee Supplemental Life Insurance is elected.

Group Term Life Page 2

Group Term Life Page 2