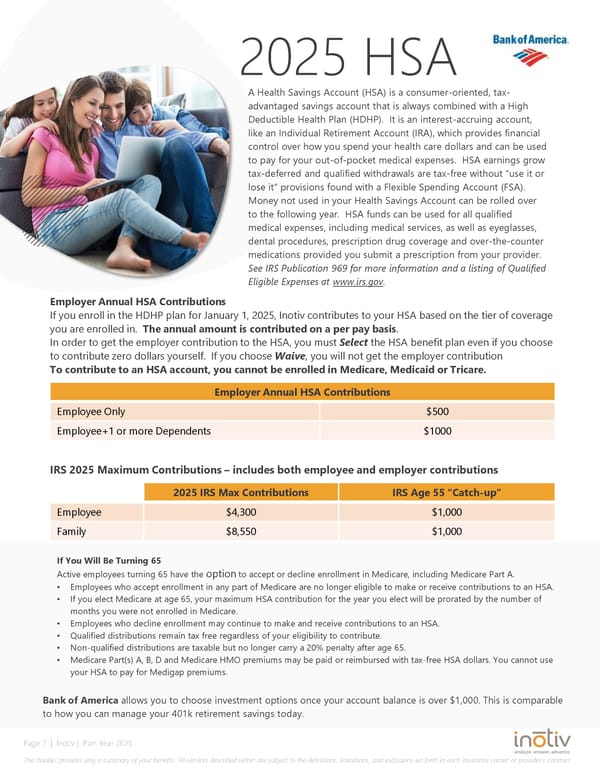

2025 HSA A Health Savings Account (HSA) is a consumer-oriented, tax- advantaged savings account that is always combined with a High Deductible Health Plan (HDHP). It is an interest-accruing account, like an Individual Retirement Account (IRA), which provides financial control over how you spend your health care dollars and can be used to pay for your out-of-pocket medical expenses. HSA earnings grow tax-deferred and qualified withdrawals are tax-free without “use it or lose it” provisions found with a Flexible Spending Account (FSA). Money not used in your Health Savings Account can be rolled over to the following year. HSA funds can be used for all qualified medical expenses, including medical services, as well as eyeglasses, dental procedures, prescription drug coverage and over-the-counter medications provided you submit a prescription from your provider. See IRS Publication 969 for more information and a listing of Qualified . Eligible Expenses at www.irs.gov Employer Annual HSA Contributions If you enroll in the HDHP plan for January 1, 2025, Inotiv contributes to your HSA based on the tier of coverage you are enrolled in. The annual amount is contributed on a per pay basis. In order to get the employer contribution to the HSA, you must Select the HSA benefit plan even if you choose to contribute zero dollars yourself. If you choose Waive, you will not get the employer contribution To contribute to an HSA account, you cannot be enrolled in Medicare, Medicaid or Tricare. Employer Annual HSA Contributions Employee Only $500 Employee+1 or more Dependents $1000 IRS 2025 Maximum Contributions – includes both employee and employer contributions 2025 IRS Max Contributions IRS Age 55 “Catch-up” Employee $4,300 $1,000 Family $8,550 $1,000 If You Will Be Turning 65 Active employees turning 65 have the option to accept or decline enrollment in Medicare, including Medicare Part A. • Employees who accept enrollment in any part of Medicare are no longer eligible to make or receive contributions to an HSA. • If you elect Medicare at age 65, your maximum HSA contribution for the year you elect will be prorated by the number of months you were not enrolled in Medicare. • Employees who decline enrollment may continue to make and receive contributions to an HSA. • Qualified distributions remain tax free regardless of your eligibility to contribute. • Non-qualified distributions are taxable but no longer carry a 20% penalty after age 65. • Medicare Part(s) A, B, D and Medicare HMO premiums may be paid or reimbursed with tax-free HSA dollars. You cannot use your HSA to pay for Medigap premiums. Bank of America allows you to choose investment options once your account balance is over $1,000. This is comparable to how you can manage your 401k retirement savings today. Page 7 | Inotiv | Plan Year 2025 This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Inotiv: Employee Benefits Guide 2025 Page 6 Page 8

Inotiv: Employee Benefits Guide 2025 Page 6 Page 8