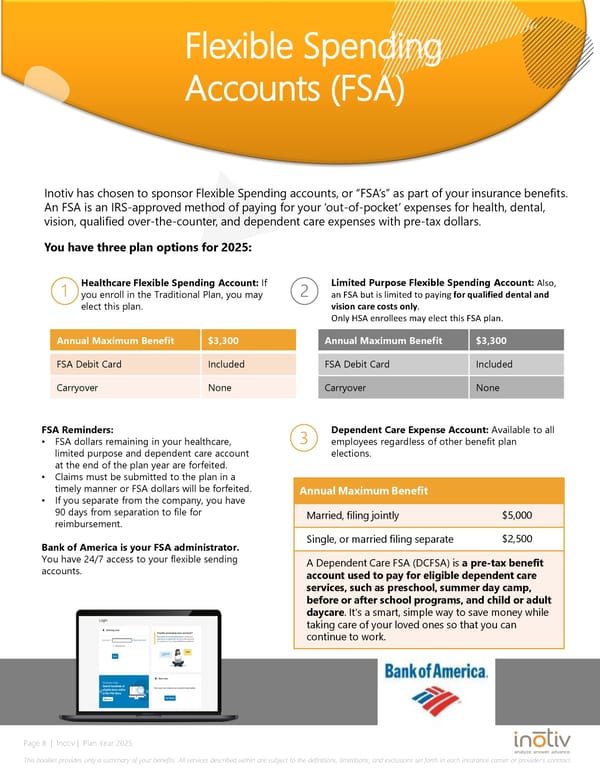

Flexible Spending Accounts (FSA) Inotiv has chosen to sponsor Flexible Spending accounts, or “FSA’s” as part of your insurance benefits. An FSA is an IRS-approved method of paying for your ‘out-of-pocket’ expenses for health, dental, vision, qualified over-the-counter, and dependent care expenses with pre-tax dollars. You have three plan options for 2025: Healthcare Flexible Spending Account: If Limited Purpose Flexible Spending Account: Also, you enroll in the Traditional Plan, you may an FSA but is limited to paying for qualified dental and elect this plan. vision care costs only. Only HSA enrollees may elect this FSA plan. Annual Maximum Benefit $3,300 Annual Maximum Benefit $3,300 FSA Debit Card Included FSA Debit Card Included Carryover None Carryover None FSA Reminders: Dependent Care Expense Account: Available to all • FSA dollars remaining in your healthcare, employees regardless of other benefit plan limited purpose and dependent care account elections. at the end of the plan year are forfeited. • Claims must be submitted to the plan in a timely manner or FSA dollars will be forfeited. Annual Maximum Benefit • If you separate from the company, you have 90 days from separation to file for Married, filing jointly $5,000 reimbursement. Bank of America is your FSA administrator. Single, or married filing separate $2,500 You have 24/7 access to your flexible sending A Dependent Care FSA (DCFSA) is a pre-tax benefit accounts. account used to pay for eligible dependent care services, such as preschool, summer day camp, before or after school programs, and child or adult daycare. It's a smart, simple way to save money while taking care of your loved ones so that you can continue to work. Page 8 | Inotiv | Plan Year 2025 This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Inotiv: Employee Benefits Guide 2025 Page 7 Page 9

Inotiv: Employee Benefits Guide 2025 Page 7 Page 9