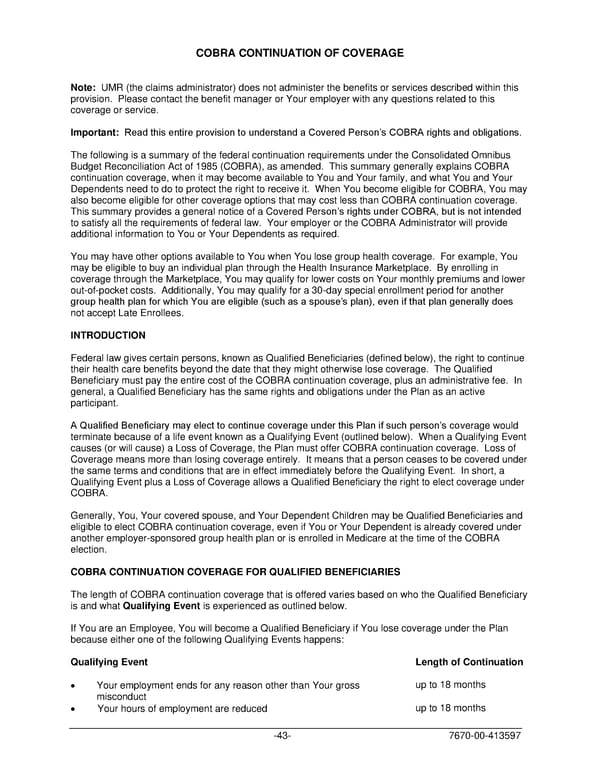

COBRA CONTINUATION OF COVERAGE Note: UMR (the claims administrator) does not administer the benefits or services described within this provision. Please contact the benefit manager or Your employer with any questions related to this coverage or service. Important: Read this entire provision to understand a Covered Person’s COBRA rights and obligations. The following is a summary of the federal continuation requirements under the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), as amended. This summary generally explains COBRA continuation coverage, when it may become available to You and Your family, and what You and Your Dependents need to do to protect the right to receive it. When You become eligible for COBRA, You may also become eligible for other coverage options that may cost less than COBRA continuation coverage. This summary provides a general notice of a Covered Person’s rights under COBRA, but is not intended to satisfy all the requirements of federal law. Your employer or the COBRA Administrator will provide additional information to You or Your Dependents as required. You may have other options available to You when You lose group health coverage. For example, You may be eligible to buy an individual plan through the Health Insurance Marketplace. By enrolling in coverage through the Marketplace, You may qualify for lower costs on Your monthly premiums and lower out-of-pocket costs. Additionally, You may qualify for a 30-day special enrollment period for another group health plan for which You are eligible (such as a spouse’s plan), even if that plan generally does not accept Late Enrollees. INTRODUCTION Federal law gives certain persons, known as Qualified Beneficiaries (defined below), the right to continue their health care benefits beyond the date that they might otherwise lose coverage. The Qualified Beneficiary must pay the entire cost of the COBRA continuation coverage, plus an administrative fee. In general, a Qualified Beneficiary has the same rights and obligations under the Plan as an active participant. A Qualified Beneficiary may elect to continue coverage under this Plan if such person’s coverage would terminate because of a life event known as a Qualifying Event (outlined below). When a Qualifying Event causes (or will cause) a Loss of Coverage, the Plan must offer COBRA continuation coverage. Loss of Coverage means more than losing coverage entirely. It means that a person ceases to be covered under the same terms and conditions that are in effect immediately before the Qualifying Event. In short, a Qualifying Event plus a Loss of Coverage allows a Qualified Beneficiary the right to elect coverage under COBRA. Generally, You, Your covered spouse, and Your Dependent Children may be Qualified Beneficiaries and eligible to elect COBRA continuation coverage, even if You or Your Dependent is already covered under another employer-sponsored group health plan or is enrolled in Medicare at the time of the COBRA election. COBRA CONTINUATION COVERAGE FOR QUALIFIED BENEFICIARIES The length of COBRA continuation coverage that is offered varies based on who the Qualified Beneficiary is and what Qualifying Event is experienced as outlined below. If You are an Employee, You will become a Qualified Beneficiary if You lose coverage under the Plan because either one of the following Qualifying Events happens: Qualifying Event Length of Continuation • Your employment ends for any reason other than Your gross up to 18 months misconduct • Your hours of employment are reduced up to 18 months -43- 7670-00-413597

PLAN 01 01 2024 00 Page 45 Page 47

PLAN 01 01 2024 00 Page 45 Page 47