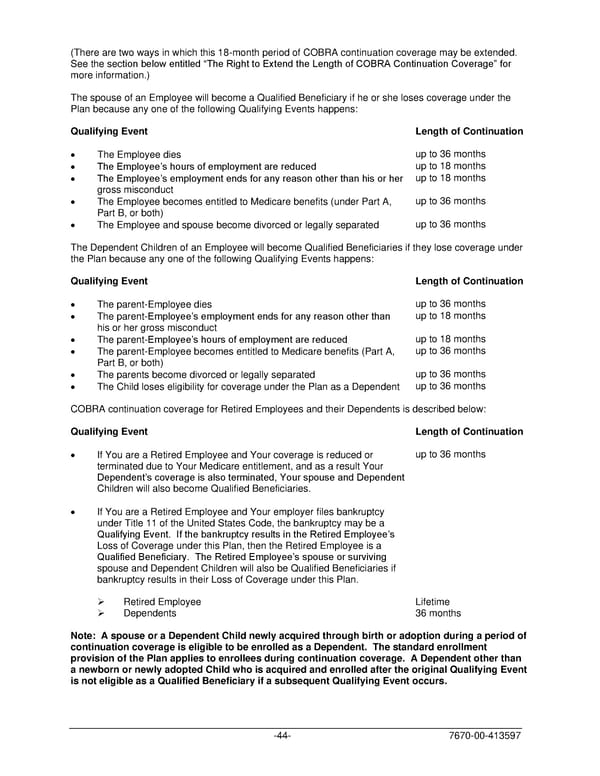

(There are two ways in which this 18-month period of COBRA continuation coverage may be extended. See the section below entitled “The Right to Extend the Length of COBRA Continuation Coverage” for more information.) The spouse of an Employee will become a Qualified Beneficiary if he or she loses coverage under the Plan because any one of the following Qualifying Events happens: Qualifying Event Length of Continuation • The Employee dies up to 36 months • The Employee’s hours of employment are reduced up to 18 months • The Employee’s employment ends for any reason other than his or her up to 18 months gross misconduct • The Employee becomes entitled to Medicare benefits (under Part A, up to 36 months Part B, or both) • The Employee and spouse become divorced or legally separated up to 36 months The Dependent Children of an Employee will become Qualified Beneficiaries if they lose coverage under the Plan because any one of the following Qualifying Events happens: Qualifying Event Length of Continuation • The parent-Employee dies up to 36 months • The parent-Employee’s employment ends for any reason other than up to 18 months his or her gross misconduct • The parent-Employee’s hours of employment are reduced up to 18 months • The parent-Employee becomes entitled to Medicare benefits (Part A, up to 36 months Part B, or both) • The parents become divorced or legally separated up to 36 months • The Child loses eligibility for coverage under the Plan as a Dependent up to 36 months COBRA continuation coverage for Retired Employees and their Dependents is described below: Qualifying Event Length of Continuation • If You are a Retired Employee and Your coverage is reduced or up to 36 months terminated due to Your Medicare entitlement, and as a result Your Dependent’s coverage is also terminated, Your spouse and Dependent Children will also become Qualified Beneficiaries. • If You are a Retired Employee and Your employer files bankruptcy under Title 11 of the United States Code, the bankruptcy may be a Qualifying Event. If the bankruptcy results in the Retired Employee’s Loss of Coverage under this Plan, then the Retired Employee is a Qualified Beneficiary. The Retired Employee’s spouse or surviving spouse and Dependent Children will also be Qualified Beneficiaries if bankruptcy results in their Loss of Coverage under this Plan. ➢ Retired Employee Lifetime ➢ Dependents 36 months Note: A spouse or a Dependent Child newly acquired through birth or adoption during a period of continuation coverage is eligible to be enrolled as a Dependent. The standard enrollment provision of the Plan applies to enrollees during continuation coverage. A Dependent other than a newborn or newly adopted Child who is acquired and enrolled after the original Qualifying Event is not eligible as a Qualified Beneficiary if a subsequent Qualifying Event occurs. -44- 7670-00-413597

PLAN 01 01 2024 00 Page 46 Page 48

PLAN 01 01 2024 00 Page 46 Page 48