Pre-65 Retiree Benefit Guide

This document provides information on the pre-65 retiree benefits offered by Ball State University, with enrollment dates from October 22 to November 6, 2025.

Enroll in Benefits October 22 – November 6, 2025 BALL STATE UNIVERSITY Pre-65 Retiree Benefits

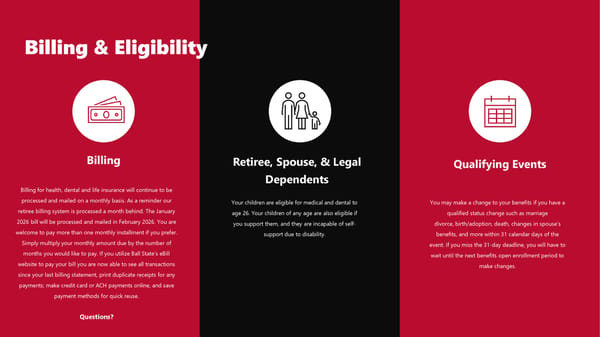

Billing Billing for health, dental and life insurance will continue to be processed and mailed on a monthly basis. As a reminder our retiree billing system is processed a month behind. The January 2026 bill will be processed and mailed in February 2026. You are welcome to pay more than one monthly installment if you prefer. Simply multiply your monthly amount due by the number of months you would like to pay. If you utilize Ball State’s eBill website to pay your bill you are now able to see all transactions since your last billing statement, print duplicate receipts for any payments; make credit card or ACH payments online, and save payment methods for quick reuse. Questions? Retiree, Spouse, & Legal Dependents Your children are eligible for medical and dental to age 26. Your children of any age are also eligible if you support them, and they are incapable of self- support due to disability. Qualifying Events You may make a change to your benefits if you have a qualified status change such as marriage divorce, birth/adoption, death, changes in spouse’s benefits, and more within 31 calendar days of the event. If you miss the 31-day deadline, you will have to wait until the next benefits open enrollment period to make changes. Billing & Eligibility

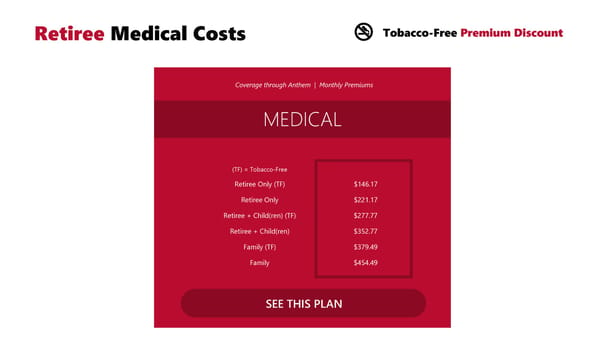

Retiree Medical Costs MEDICAL Coverage through Anthem | Monthly Premiums SEE THIS PLAN (TF) = Tobacco-Free Retiree Only (TF) $146.17 Retiree Only $221.17 Retiree + Child(ren) (TF) $277.77 Retiree + Child(ren) $352.77 Family (TF) $379.49 Family $454.49 Tobacco-Free Premium Discount

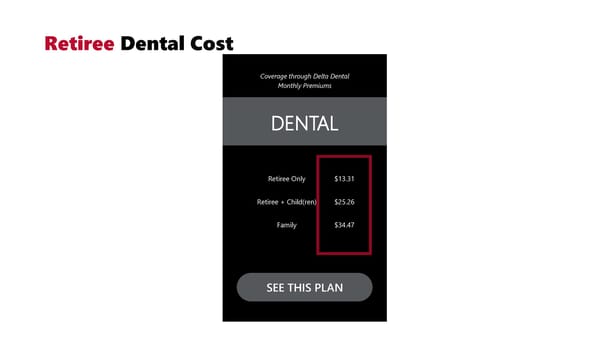

Retiree Dental Cost DENTAL Coverage through Delta Dental Monthly Premiums SEE THIS PLAN Retiree Only $13.31 Retiree + Child(ren) $25.26 Family $34.47

Medical BENEFITS Medical coverage will remain with Anthem in 2026. Visit the Anthem portal or the Sydney Health mobile app to view your ID card, progress toward your deductible, and shop for providers in your area! View Your Anthem Portal

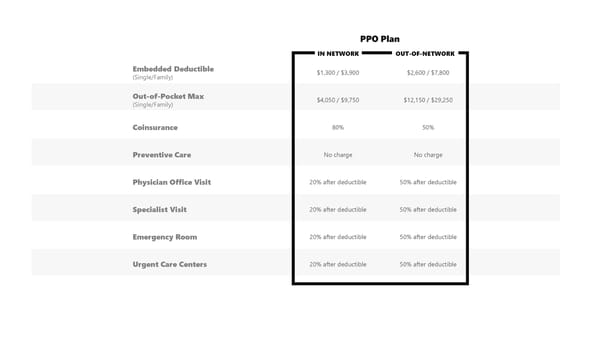

PPO Plan IN NETWORK OUT-OF-NETWORK Embedded Deductible (Single/Family) $1,300 / $3,900 $2,600 / $7,800 Out-of-Pocket Max (Single/Family) $4,050 / $9,750 $12,150 / $29,250 Coinsurance 80% 50% Preventive Care No charge No charge Physician Office Visit 20% after deductible 50% after deductible Specialist Visit 20% after deductible 50% after deductible Emergency Room 20% after deductible 50% after deductible Urgent Care Centers 20% after deductible 50% after deductible

Anthem’s Sydney Health App Manage Your Claims With Sydney Health, you can submit and track your claims, anytime, anywhere. Compare Care & Costs Our digital tools can help you find doctors in your plan’s network and compare care costs up front. Schedule Virtual Appointments Schedule same-day virtual appointments with licensed physicians. Download the App Watch Sydney Health App Video

24/7 Virtual Doctor Visits 24/7 access to U.S. licensed doctors by phone or video Doctors can diagnose, treat, & prescribe medication Quality care from wherever you are Register or Schedule Online Download the App You may schedule an appointment with a board– certified doctor online anytime of the day or night using LiveHealth Online on your smartphone, tablet or computer. You don’t even have to leave your home.

Prescription DRUGS Register online at www.Caremark.com/startnow to find network pharmacies, refill medications and check order status, check drug cost, and see your prescription history. We strive for all plan members to check costs for prescriptions and see if alternatives are available. By being good stewards of our insurance expenditures, we can all work to keep our health claims and insurance premiums low. Caremark Member Portal

PPO Plan Rx Deductible N/A Single / Family Rx Out-of-Pocket Max $1,725 / $3,450 Retail Prescriptions: Generic 20% coinsurance ($7 min / $25 max) Retail Prescriptions: Preferred 40% coinsurance ($35 min) Retail Prescriptions: Non-Preferred 50% coinsurance ($60 min) Retail Prescriptions: Specialty $110 copay Mail Order Prescriptions: Generic 20% coinsurance ($15 min / $65 max) Mail Order Prescriptions: Preferred 40% coinsurance ($70 min / $110 max) Mail Order Prescriptions: Non-Preferred 50% coinsurance ($120 min / $160 max)

How do Rx Benefits work? Medical ID Provide the pharmacy with your medical ID card. Insurance Coverage The pharmacy will run your prescriptions through insurance and the total amount due is owed to the pharmacy. Deductible Reached Once you reach the deductible amount, you will then pay the reduced Rx coinsurance amount based on the tier of your drug. Deductible Contribution The total amount owed will then count towards your deductible. Out-of-Pocket Max Once you reach your total out-of-pocket max, your employer will pay 100%.

Pharmacy Cost TOOLS GoodRx GoodRx has both a website and a mobile app that can be used to compare prices. Go to the website and type in your drug name. GoodRx will display the cost available at multiple pharmacies. Print the coupon and present to your pharmacist. Learn More Rx Help Centers RX Help Centers provides assistance in finding resources for high-cost brand name medications by advocating directly with drug manufacturers. Learn More CostPlus Drug Company The goal of the Mark Cuban Cost Plus Drug Company is to dramatically reduce the cost of drugs and introduce transparency to the pricing of drugs, so patients know they are getting a fair price. Learn More Watch Pharmacy Coupon Video

DENTAL Delta Dental offer three levels of benefits coverage; PPO Dentist, Premier Dentist, and Non-Participating Dentist. Find providers, view your ID card, and more online or using the mobile app. Dental Coverage with Delta Dental DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 317-842-4022 KRISTEN JONES Group Delta Dental PPO Online Portal Download the App

Deductible $60 per covered member, $150 per family Annual Plan Maximum $1,500 / person Preventive Services Exams, Cleanings, Fluoride, X-Rays You Pay 0% Basic Services Fillings, Extractions, Endodontics, Crown Repairs You Pay 15% Major Services Crowns, Dentures, In/Outlays, Periodontics You Pay 30% Orthodontia Services To Age 19: You Pay 30% Age 19 and Over: You Pay 50% Orthodontia Maximum To Age 19: $500 per Year Age 19 and Over: $500 per Lifetime

Life insurance administration is moving from The Hartford to Voya in 2026. With Group Term Life Insurance, your beneficiaries will be paid proceeds if you pass away during the term of the coverage. The term is generally one year, renewing annually with other employer-offered benefits. Basic Life INSURANCE Benefit Basic life volume for retirees equals 50% of the volume of employer-sponsored group term life in force prior to your retirement. Maximum Benefit maximum is $37,500. There is no age reduction on this plan. Premiums Premiums for this benefit are paid using your monthly premium bills. Ball State subsidizes the majority of the cost of premiums, but your share will continue to cost $8.50 per month to participate.