DePauw University 2025 Benefit Guide

2025 Benefits Plan

Your 2025 Benefits Your health and financial security is important to us. We believe DePauw’s benefit program provides a variety of plans that can enhance the lives of yourself – both now and in the future. As an eligible employee, you will be asked to make decisions about the employee benefits described in this guide. Take time to read it carefully and use the available resources to ensure you make the decisions that are right for you and your family.

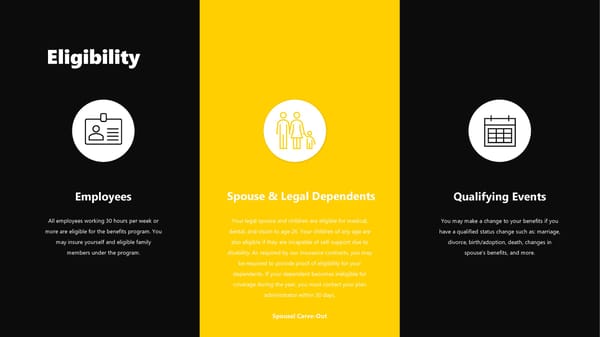

Eligibility Employees Spouse & Legal Dependents Qualifying Events All employees working 30 hours per week or Your legal spouse and children are eligible for medical, You may make a change to your benefits if you more are eligible for the benefits program. You dental, and vision to age 26. Your children of any age are have a qualified status change such as: marriage, may insure yourself and eligible family also eligible if they are incapable of self-support due to divorce, birth/adoption, death, changes in members under the program. disability. As required by our insurance contracts, you may spouse’s benefits, and more. be required to provide proof of eligibility for your dependents. If your dependent becomes ineligible for coverage during the year, you must contact your plan administrator within 30 days. Spousal Carve-Out

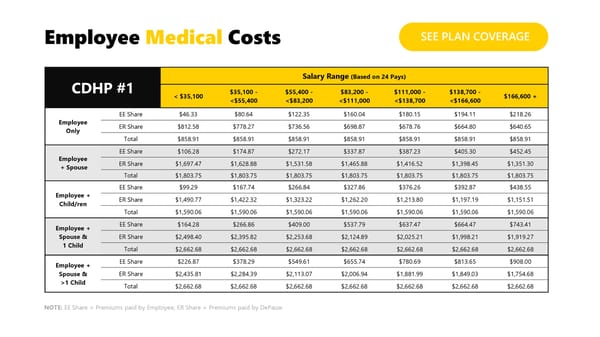

Employee Medical Costs SEE PLAN COVERAGE CDHP #1 Salary Range (Based on 24 Pays) < $35,100 $35,100 - $55,400 - $83,200 - $111,000 - $138,700 - $166,600 +

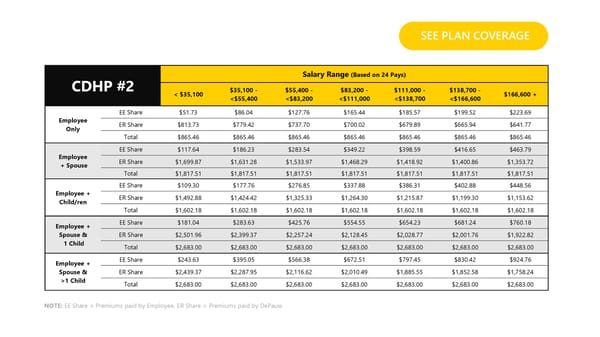

SEE PLAN COVERAGE CDHP #2 Salary Range (Based on 24 Pays) < $35,100 $35,100 - $55,400 - $83,200 - $111,000 - $138,700 - $166,600 +

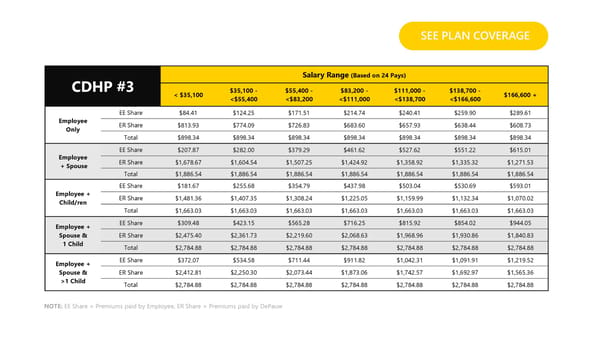

SEE PLAN COVERAGE CDHP #3 Salary Range (Based on 24 Pays) < $35,100 $35,100 - $55,400 - $83,200 - $111,000 - $138,700 - $166,600 +

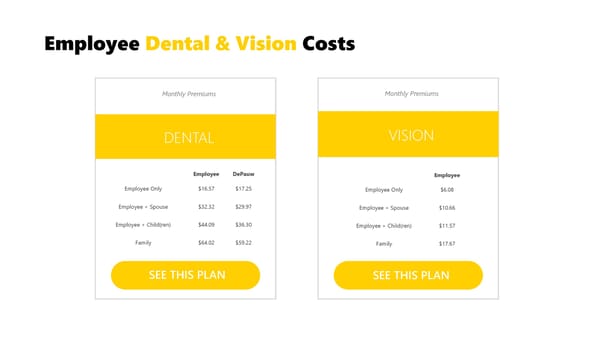

Employee Dental & Vision Costs Monthly Premiums Monthly Premiums DENTAL VISION Employee DePauw Employee Employee Only $16.57 $17.25 Employee Only $6.08 Employee + Spouse $32.32 $29.97 Employee + Spouse $10.66 Employee + Child(ren) $44.09 $36.30 Employee + Child(ren) $11.57 Family $64.02 $59.22 Family $17.67 SEE THIS PLAN SEE THIS PLAN

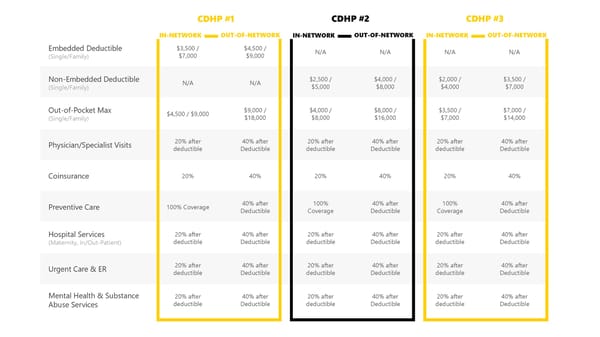

Medical BENEFITS For 2025, DePauw University is offering 3 Consumer-Driven Health Plans through UMR. View Your UMR Portal

CDHP #1 CDHP #2 CDHP #3 IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK Embedded Deductible $3,500 / $4,500 / N/A N/A N/A N/A (Single/Family) $7,000 $9,000 Non-Embedded Deductible N/A N/A $2,500 / $4,000 / $2,000 / $3,500 / (Single/Family) $5,000 $8,000 $4,000 $7,000 Out-of-Pocket Max $4,500 / $9,000 $9,000 / $4,000 / $8,000 / $3,500 / $7,000 / (Single/Family) $18,000 $8,000 $16,000 $7,000 $14,000 Physician/Specialist Visits 20% after 40% after 20% after 40% after 20% after 40% after deductible Deductible deductible Deductible deductible Deductible Coinsurance 20% 40% 20% 40% 20% 40% Preventive Care 100% Coverage 40% after 100% 40% after 100% 40% after Deductible Coverage Deductible Coverage Deductible Hospital Services 20% after 40% after 20% after 40% after 20% after 40% after (Maternity, In/Out-Patient) deductible Deductible deductible Deductible deductible Deductible Urgent Care & ER 20% after 40% after 20% after 40% after 20% after 40% after deductible Deductible deductible Deductible deductible Deductible Mental Health & Substance 20% after 40% after 20% after 40% after 20% after 40% after Abuse Services deductible Deductible deductible Deductible deductible Deductible

UMR Mobile App & Desktop Portal 1 Store & Easily Access Virtual ID Cards 2 Manage Claims for You & Your Dependents 3 Track Your Deductible & Out-of-Pocket Max Totals 4 Find In-Network Providers Download the UMR App View Your UMR Portal

24/7 Virtual Doctor Visits 24/7 access to U.S. Doctors can diagnose, Quality care from licensed doctors by treat, & prescribe wherever you are phone or video medication Download the App Register or Schedule Online

Buehler Health Services Clinic visits – annual physicals, musculoskeletal and Wellness visits, sick visits, and wellness coaching. Chronic disease management – support from clinical staff to better manage conditions such as SUITES CLINIC diabetes, high cholesterol, asthma and others. Health risk assessments – helps identify targeted concerns and preventive health goals. Powered by DePauw’s Health Services Referrals and care navigation – support in the Partner Hendrick’s Regional Health coordination of specialty referrals when needed, as well as the management of follow-up care. The campus Wellness Center is available to all faculty and staff Home Delivery & On-site Pharmacy – features participating in the DePauw University Health Plan, as well as a formulary of the most commonly utilized their enrolled dependents. Buehler Health and Wellness Suites medications. clinic is located on the second floor of The Lilly Center. There is Lab draws – conveniently available on-site with rapid results turnaround. no fee for most services provided in the wellness center as they are covered through health insurance premium contributions. Wellness Coaching Please call (317) 718-8160 to schedule a Schedule Appointment personalized wellness coaching appointment with a certified Wellness Nurse.

Prescription DRUGS In 2025, CVS Caremark will continue as DePauw’s dedicated partner for pharmacy management. The Caremark network includes most retail chain pharmacies such as Walgreens, CVS, and Walmart. Mail order prescriptions can be ordered directly through Caremark. A preventive drug list can be found using the Caremark Portal link below. Visit Caremark Portal Download App

All CDHP Plans IN NETWORK OUT-OF-NETWORK Retail Prescriptions: 0% after Deductible 40% after Deductible Generic Retail Prescriptions: 40% after Deductible 40% after Deductible Preferred Retail Prescriptions: 50% after Deductible 40% after Deductible Non-Preferred Mail Order Prescriptions: 0% after Deductible Not Covered Generic Mail Order Prescriptions: 40% after Deductible Not Covered Preferred Mail Order Prescriptions: 50% after Deductible Not Covered Non-Preferred

How does CVS Caremark work? Deductible Contribution Insurance Coverage The total amount owed will then count The pharmacy will run your prescriptions towards your deductible. through insurance and the total amount due is owed to the pharmacy. Deductible Reached Once you reach the deductible amount, you will then pay your share of coinsurance per the chart on the previous slide. Medical ID Provide the pharmacy with your medical ID card. Out-of-Pocket Max Once you reach your total out-of-pocket max, your employers will pay 100%.

Health Savings ACCOUNT A Health Savings Account (HSA) is available to those enrolled Company contribution up to in a High Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses all tax-free. Any $2,000 unused earnings rollover from year-to-year.

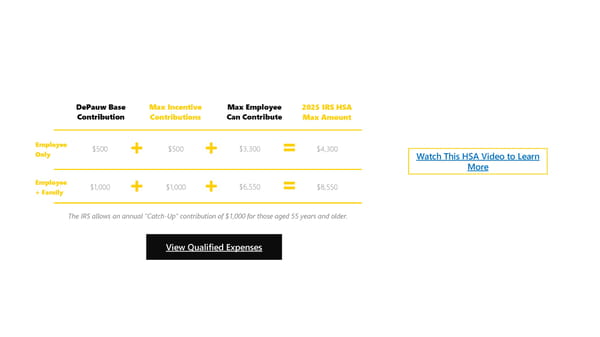

DePauw Base Max Incentive Max Employee 2025 IRS HSA Contribution Contributions Can Contribute Max Amount Employee $500 + $500 + $3,300 = $4,300 Only Watch This HSA Video to Learn More Employee $1,000 + $1,000 + $6,550 = $8,550 + Family The IRS allows an annual "Catch-Up" contribution of $1,000 for those aged 55 years and older. View Qualified Expenses

HSA Benefits Employee Spouse Employee + Child(ren) Our Healthy Tigers is a wellness program designed DePauw Base $500 $500 $1,000 to incentivize you to prioritize your preventive care Contribution through earned employer HSA contributions. In Annual Physical $150 $150 $300 addition to your annual base employer HSA Biometric Screening $150 $150 $300 contribution, you can earn up to an extra $500 (if Any 4 Health Action $200 $200 $400 enrolled in Employee-Only coverage) or $1,000 (if Activities enrolled in Employee + Dependent(s) coverage) of Maximum Employer $1,000 $1,000 $2,000 contributions to your Health Savings Account. HSA Contribution Learn More About Healthy Tigers Visit WellRight Portal

CDHP and HSA Consumer Experience Doctor Visit Amount Owed EOB Bill Received Pay with HSA Visit your healthcare provider and The health plan will share the The health plan will send you Your doctor will then You can use your HSA the office will submit the claim to amount you owe with your the Explanation of Benefits send you a bill. funds to pay the bill from your health plan. doctor. (EOB). your doctor.

Flexible Spending Account Watch This FSA Video to Learn Flexible Spending Accounts (FSA) are set up to pay for More many of out-of-pocket medical expenses with tax-free dollars. The FSA account holder sets aside a pre-tax dollar amount for the year used to pay for medical expenses. Unused FSA funds can expire at the end of the year. Dependent Care Account (DCA) A DCA is a tax-free spending account for dependent care expenses such as daycare, preschool, or day camps for any dependent under the age of 13. You may also use funds for elder care for older family members legally under your care. Learn More About Your DCA

DENTAL DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 317-842-4022 Dental Coverage with Delta Dental KRISTEN JONES Group Delta Dental PPO Delta Dental offers three levels of benefits coverage: PPO Dentist, Premier Dentist, and Non-Participating Dentist. Find providers, view your ID card, and more on the Delta Dental online portal or on their mobile app. Online Portal Download the App

PPO PREMIER OUT-OF-NETWORK Deductible $50 / $100 $50 / $100 $50 / $100 (Single/Family) Annual Plan Maximum $1,250 $1,250 $1,250 Preventive Services You Pay 0% You Pay 0% You Pay 0% Exams, Cleanings, Fluoride, X-Rays Basic Services You Pay 20% You Pay 20% You Pay 20% Fillings, Extractions, Endodontics, Crown Repairs Major Services You Pay 50% You Pay 50% You Pay 50% Crowns, Dentures, In/Outlays, Bridges, Implants Orthodontia Services You Pay 50% You Pay 50% You Pay 50% Orthodontia Lifetime Maximum $1,000 $1,000 $1,000

VISION Vision Coverage through Anthem Anthem Blue Cross and Blue Shield vision members have access to one of the nation’s largest network of vision providers. Blue View Vision is the only network that gives you the ability to use in-network benefits at 1-800- CONTACTS, or choose a private eye doctor, or go to retail vendors. Online Portal

In-Network Out-of-Network Exam $10 copay $42 allowance Glasses Lenses $10 copay $40 - $80 allowance (Single / Bifocal/ Trifocal) Glasses Frames $130 retail frame allowance $45 allowance + 20% off remaining balance Contact Lenses Covered in Full / $210 allowance / (Medically Necessary / Elective) $130 allowance $105 allowance Routine eye exams, glasses lenses, and contacts available once every 12 months. Frames available once every 24 months.

Additional BENEFITS DePauw University provides employees with employer-paid life insurance and long-term disability coverage. Employees also have the option to enroll in voluntary, employee-paid benefits such as additional life insurance, accident or critical illness insurance, and identity theft protection.

Basic Life Insurance Voluntary Life Insurance In exchange for premium payments, the insurance company Employees have the option to purchase additional life provides a lump-sum payment, known as a death benefit, insurance. to beneficiaries upon the insured's death. Employee Benefit: Increments of $10,000 up to $500,000. The employer-paid basic life insurance policy is available Guarantee issue fluctuates based on age bands. to all full-time employees. In the event of your death, your Spouse Benefit: Increments of $5,000 up to $50,000. beneficiaries will receive 2x's Annual Base Salary up to Guarantee issue fluctuates based on age bands. $450,000. Coverage will decrease incrementally at age 65. Child(ren) Benefit: Benefit amount of $10,000 or $20,000 (cannot exceed 50% of employee amount). Guaranteed issue of $20,000. Long-Term Disability Basic Accidental Death & Employer-paid long-term disability protects your income for Dismemberment Insurance a period of time due to illness, maternity leave, or an accident The employer-paid basic AD&D insurance policy is not related to your job. available to all full-time employees. In the event of death, Benefits begin 180 days after the date of the incident and will loss of a body part or function, speech, eyesight, or hearing, cover 60% of your earnings up to a max monthly benefit of your beneficiaries will receive 1x's Annual Base Salary up to $10,000 (Salaried employees) or $2,500 (Hourly employees). $180,000. Coverage will decrease incrementally at age 65.

Voluntary Benefits Accident Insurance Critical Illness Insurance Designed to cover accidents that occur when This insurance pays fixed cash benefits directly to you employees are not at work. This insurance pays upon diagnosis of a covered critical illness after the fixed cash benefits directly to you for specific coverage effective date. These benefits can help pay injuries, procedures or death as a result of a for out-of-pocket medical and non-medical expenses covered accident. There are no health questions your medical insurance doesn’t cover. Examples of asked or pre-existing conditions limitations. covered illnesses are heart attack and/or stroke, Learn More Alzheimer’s, ALS, cancer, certain childhood conditions and others. You are able to choose the benefit Identity Theft Protection amounts that best meet your needs and your budget. You have the support of a comprehensive Learn More Identity Theft Protection program through Assist Emergency Travel Assistance America’s SecurAssist Identity Protection program. It provides: 24x7 telephone support As an active employee enrolled in Sun Life’s Life or and step-by-step guidance by anti-fraud experts, Accident insurance, you and your immediate family a case worker assigned to you to help you notify are members of Assist America and are entitled to its the credit bureaus and file paperwork to correct services, including: medical consultation, evaluation, your credit reports, help canceling stolen cards and referral, hospital admission, critical care and reissuing new cards, and help notifying monitoring, and lost prescription assistance. financial institutions and government agencies.

All employees may participate in DePauw's sponsored 403(b) Retirement 403(b) retirement plan, but only full-time employees contributing at least 5% are eligible to receive an 8% employer match. Enroll Today Help Planning Retirement New employees are automatically enrolled in the 403(b) Meet with your dedicated TIAA representative. They retirement plan. Log into your TIAA portal to view and can assist with questions such as: Am I on track? Am change your contributions today! I saving enough? Can I retire when I want? Manage Contributions CapTrust • TIAA Login DePauw University has selected the CapTrust (formerly • Click here to schedule an appointment Cammack Retirement) Team to provide investment • How to start, stop or change your 403(b) Contribution advisory, consulting and compliance services for the • How to update your TIAA beneficiary information DePauw University Retirement Savings Plan.

Employee Clinical Assistance Confidential assistance for a range of concerns including addictions, depression, anxiety, stress, PROGRAM relationships, and parenting. This benefit is for all full- and part-time DPU employees Wellness whether or not you are on the DPU medical plan. When you Telephone based wellness coaching for tobacco find yourself in need of some professional support to deal cessation, weight loss management, fitness and with personal, work, financial, or family issues, your EAP can exercise, stress management, parenting, and assist. You have 3 free, confidential counseling sessions per relationship support. year available to you and dependents 24/7/365. Use the link below or call 1.877.622.4327 to get started. Work-Life Assistance for daily challenges at home and work Get Help Employee ID: including financial, legal, child/elder care, and depauwuniversity identity theft.

UMR Behavioral Health Providers This benefit is for DPU employees and dependents on the DePauw Health Plan. Services are subject to Mental Health deductible, coinsurance, and out-of-pocket BENEFITS maximums. Find providers on www.umr.com. DePauw’s Spiritual Life Team Chaplain Maureen If you are suffering from a mental health condition, have • mklangdoc@depauw.edu | 765-365-2269. hope: you are not alone. Depression, anxiety, substance use Chaplain Jonathan disorders, trauma, and other conditions affect people from • jonathanmartin@depauw.edu | 704-975-9284 all walks of life. Below are just a few resources available. BeWell Indiana Support & Resources In addition to mental health resources, there are a wide range of free resources for Hoosiers available here. For example, help with substance use disorder & recovery resources, child care solutions, and more. You can start by calling 2-1- 1. For crisis help text the word “HOME” to 741741.

Tuition Benefits Note: Employees are eligible for tuition benefits on their date of hire, and spouses and dependents are eligible after two years of your full-time employment. Employees Spouse & Dependents An employee is eligible for Tuition Waiver with course Tuition remission is available for eligible spouses credit or may audit a course for no course credit and dependent children of active DePauw regardless of the degree(s) held. If you would like to employees. Spouses should complete the tuition remission application using this form submit an application for tuition waiver, use this form . and submit to the Human Resources office. Member Institution (GLCA) Tuition Exchange School Dependent children are also eligible for tuition Dependent children of a full-time benefit eligible remission benefits at the member institutions of employee who has met the two-year continuous the Great Lakes Colleges Association. Visit the GLCA employment requirement are considered qualified site for more information about the Tuition Remission for the Tuition Exchange program. Information on Exchange. Use the application form and print and the Tuition Exchange, including the application return to the DePauw Human Resources office. form for the consideration for a scholarship, can be found at its website.

Paid Holidays November 28th th Thanksgiving Break th, 2024 Memorial Day May 26 , 2025 and 29 December 23rd, 2024 – th Winter Break st Independence Day July 4 , 2025 January 1 , 2025 th st MLK Day January 20 , 2025 Labor Day September 1 , 2025 st th Spring Break March 21 , 2025 Thanksgiving November 27

Workday Enroll in Great Benefits Today! Enroll Online