Elkhart Community Schools Employee Benefits Guide 2025

This document provides information on the employee benefits and open enrollment period for Elkhart Community Schools from November 6th to 17th, 2025.

Elkhart Community Schools Employee Benefits th nd 2025 Open Enrollment November 11 – 22

Your 2025 Benefits The health and financial security of you and your family is important to us. Our benefit program provides a variety of plans that can enhance the lives of you and your family – both now and in the future. As an eligible employee, you will be asked to make decisions about the employee benefits described in this booklet. This guide provides information to enable you to effectively enroll in your benefits. Take time to read it carefully and use the available resources to ensure you make the decisions that are right for you and your family. Julie Gruver INSURANCE SECRETARY

Eligibility Employees Spouse & Legal Dependents Qualifying Events All employees working 30 hours per week, or Your children are eligible for medical, dental, and vision to You may make a change to your benefits if you more are eligible for the benefits program. You age 26. Your children of any age are also eligible if you have a qualified status change such as: marriage may insure yourself and eligible family support them, and they are incapable of self-support due to divorce, birth/adoption, death, changes in members under the program. disability. As required by our insurance contracts, you may spouse’s benefits, and more. be required to provide proof of eligibility for your dependents. If your dependent becomes ineligible for coverage during the year, you must contact your plan administrator within 30 days.

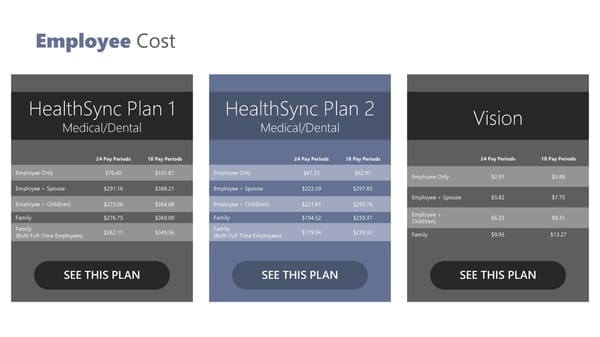

Employee Cost HealthSync Plan 1 HealthSync Plan 2 Vision Medical/Dental Medical/Dental 24 Pay Periods 18 Pay Periods 24 Pay Periods 18 Pay Periods 24 Pay Periods 18 Pay Periods Employee Only $76.40 $101.87 Employee Only $47.23 $62.97 Employee Only $2.91 $3.88 Employee + Spouse $291.16 $388.21 Employee + Spouse $223.39 $297.85 Employee + Child(ren) $273.06 $364.08 Employee + Child(ren) $221.81 $295.74 Employee + Spouse $5.82 $7.75 Family $276.75 $369.00 Family $194.52 $259.37 Employee + $6.23 $8.31 Child(ren) Family $262.17 $349.56 Family $179.94 $239.92 Family $9.95 $13.27 (Both Full-Time Employees) (Both Full-Time Employees) SEE THIS PLAN SEE THIS PLAN SEE THIS PLAN

Pay and Deduction Calendar 24 Deduction 18 Deduction JANUARY FEBRUARY MARCH APRIL 1 2 3 4 1 1 1 2 3 4 5 5 6 7 8 9 10 11 2 3 4 5 6 7 8 2 3 4 5 6 7 8 6 7 8 9 10 11 12 12 13 14 15 16 17 18 9 10 11 12 13 14 15 9 10 11 12 13 14 15 13 14 15 16 17 18 19 19 20 21 22 23 24 25 16 17 18 19 20 21 22 16 17 18 19 20 21 22 20 21 22 23 24 25 26 26 27 28 29 30 31 23 24 25 26 27 28 23/ 24/ 25 29 27 28 29 27 28 29 30 30 31 MAY JUNE JULY AUGUST 1 2 3 1 2 3 4 5 6 7 1 2 3 4 5 1 2 4 5 6 7 8 9 10 8 9 10 11 12 13 14 6 7 8 9 10 11 12 3 4 5 6 7 8 9 11 12 13 14 15 16 17 15 16 17 18 19 20 21 13 14 15 16 17 18 19 10 11 12 13 14 15 16 18 19 20 21 22 23 24 22 23 24 25 26 27 28 20 21 22 23 24 25 26 17 18 19 20 21 22 23 25 26 27 28 29 30 31 29 30 27 28 29 30 31 24/ 25 26 27 28 29 30 31 SEPTEMBER OCTOBER NOVEMBER DECEMBER 1 2 3 4 5 6 1 2 3 4 1 1 2 3 4 5 6 7 8 9 10 11 12 13 5 6 7 8 9 10 11 2 3 4 5 6 7 8 7 8 9 10 11 12 13 14 15 16 17 18 19 20 12 13 14 15 16 17 18 9 10 11 12 13 14 15 14 15 16 17 18 19 20 21 22 23 24 25 26 27 19 20 21 22 23 24 25 16 17 18 19 20 21 22 21 22 23 24 25 26 27 28 29 30 26 27 28 29 30 31 23/ 24 25 26 27 28 29 28 29 30 31 30

PlanSource Get Enrolled Today! Username: First initial of your first name, the first six characters of your last name and the last four (4) digits of your SSN. Example: John Employee – SSN – 000-00-1234 Username would be jemploy1234 Password: Your Date of Birth formatted as YYYYMMDD. (ex June 1, 1980 = 19800601) Enroll Online

Anthem HEALTHSYNC HealthSync is a network of high-performing practices offering value-based care. That means you get a physician who’s truly invested in your health; one who builds a strong relationship with their patients. And better relationships often mean better health. It also means: INDIVIDUALIZE CARE AFFORDABLE CARE LOWER DEDUCTIBLES & COINSURANCE Find HealthSync Providers

HealthSync HDHP 1 HealthSync HDHP 2 Tier 1 HealthSync Tier 2 In-Network Out-of-Network Tier 1 HealthSync Tier 2 In-Network Out-of-Network Embedded $3,000 / Deductible ($3,300 Individual) $6,000 $5,000 / $10,000 $15,000 / $30,000 $4,000 / $8,000 $5,500 / $11,000 $16,500 / $33,000 (Single/Family) (Family) Embedded Out-of-Pocket Max $7,000 / $14,000 $7,000 / $14,000 $21,000 / $42,000 $7,000 / $14,000 $7,000 / $14,000 $21,000 / $42,000 (Single/Family) Coinsurance 0% 20% 50% 20% 40% 50% Preventive Care 100% Coverage 100% Coverage Deductible, then 100% Coverage 100% Coverage 50% after Deductible coinsurance Primary Care Deductible, then $15 Deductible, then $40 Deductible, then Deductible, then Deductible, then Deductible, then Copay Copay + Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Specialist Visit Deductible, then $30 Deductible, then $80 Deductible, then Deductible, then Deductible, then Deductible, then Copay Copay + Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Hospital 0% after Deductible Deductible, then $500 Deductible, then Deductible, then Deductible, then $500 Deductible, then Inpatient Copay + Coinsurance Coinsurance Coinsurance Copay + Coinsurance Coinsurance Hospital 0% after Deductible Deductible, then $250 Deductible, then Deductible, then Deductible, then $250 Deductible, then Outpatient Copay + Coinsurance Coinsurance Coinsurance Copay + Coinsurance Coinsurance Deductible, then $250 Deductible, then $250 Deductible, then $250 Deductible, then $250 Deductible, then $250 Deductible, then $250 Emergency Room Copay and 0% Copay and 0% Copay and 0% Copay + Coinsurance Copay + Coinsurance Copay + Coinsurance Coinsurance Coinsurance Coinsurance Urgent Care Deductible, then $75 Deductible, then $150 Deductible, then Deductible, then Deductible, then Deductible, then Centers Copay Copay + Coinsurance Coinsurance Coinsurance Coinsurance Coinsurance Virtual Visits – 20% after Deductible 20% after Deductible 20% after Deductible 20% after Deductible 20% after Deductible 20% after Deductible (Preferred Online Provider)

Anthem’s Sydney Health App Manage Your Claims With Sydney Health, you can submit and track your claims, anytime, anywhere. Watch Sydney Health App Video Compare Care & Costs Our digital tools can help you find doctors in your plan’s network and compare care costs up front. Access Your ID Card Your digital ID card is always with you when you need it. Download the App

Navigate Healthcare Navigation Find vetted healthcare providers, prepare for a Healthcare doctor’s visit, and caregiving support. BETTER Chronic Conditions Arthritis, diabetes, heart conditions, back, shoulder, Summus is now part of your employee benefits package at no hip, knee, and wrist conditions. cost to you. Summus connects you with high-quality specialists to answer all your health questions. To get fast access to top doctors across all health issues, contact Summus anytime by Mental Health & Wellbeing calling 971-565-8540, emailing [email protected] Mental health, stress management, sleep, nutrition, or visiting their website at summusglobal.com. and weight management. Specialized Healthcare Needs Get Help Cancer, LGBTQIA+ health, fertility and high-risk pregnancy, pediatric and teen health.

Prescription DRUGS Pharmacy coverage for Anthem HealthSync plans is offered through the CVS network. Prescriptions count towards your Tier 2 deductible. Savings opportunities are available through Rx Help Centers and CostPlus Rx. Savings may not count towards your deductible. CVS Pharmacy Rx Help Centers CostPlus Rx

HealthSync HDHP Plan 1 HealthSync HDHP Plan 2 Retail 10% after Deductible 10% after Deductible Generic and Preferred Retail 20% after Deductible 20% after Deductible Non-Preferred Mail Order 10% after Deductible 10% after Deductible Generic and Preferred Mail Order 20% after Deductible 20% after Deductible Non-Preferred Specialty Deductible and Coinsurance Deductible and Coinsurance Generic Specialty Deductible and Coinsurance Deductible and Coinsurance Brand

How does Pharmacy Coverage work? Deductible Contribution Insurance Coverage The total amount owed will then count The pharmacy will run your prescriptions towards your deductible. through insurance and the total amount due is owed to the pharmacy. Deductible Reached Once you reach the deductible amount, you will then pay your coinsurance %. Medical ID Provide the pharmacy with your medical ID card. Out-of-Pocket Max Once you reach your total out-of-pocket max, your employers will pay 100%.

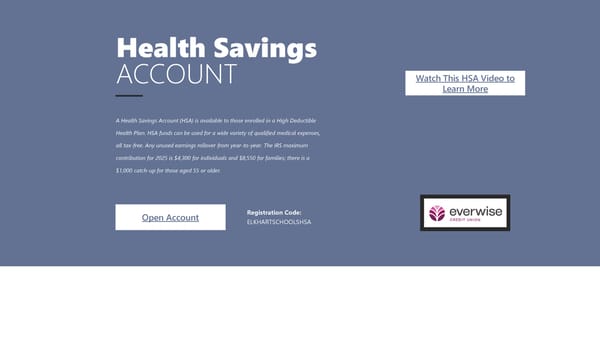

Health Savings ACCOUNT Watch This HSA Video to Learn More A Health Savings Account (HSA) is available to those enrolled in a High Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses, all tax-free. Any unused earnings rollover from year-to-year. The IRS maximum contribution for 2025 is $4,300 for individuals and $8,550 for families; there is a $1,000 catch-up for those aged 55 or older. Open Account Registration Code: ELKHARTSCHOOLSHSA

HDHP and HSA Consumer Experience Doctor Visit Amount Owed EOB Bill Received Pay with HSA Visit your healthcare provider and The health plan will share the The health plan send you the Your doctor will then send you You can use your HSA funds the office will submit the claim to amount you owe with your Explanation of Benefits (EOB). a bill. to pay the bill from your your health plan. doctor. doctor.

DENTAL DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 317-842-4022 Dental Coverage with Delta Dental KRISTEN JONES Group Delta Dental PPO Delta Dental offer three levels of benefits coverage; PPO Dentist, Premier Dentist, and Non-Participating Dentist. Find providers, view your ID card, and more online or using the mobile app. Online Portal Download the App

Deductible (Single / Family) $25 / $50 Annual Plan Maximum $1,250 Preventive Services 80% Covered Exams, Cleanings, Fluoride, X-Rays Basic Services 80% Covered Fillings, Extractions, Endodontics, Crown Repairs Major Services 80% Covered Crowns, Dentures, In/Outlays, Periodontics Orthodontia Services 60% Covered Children up to age 19 Orthodontia Lifetime Maximum $1,200

VISION DeltaVision through the VSP network For exam services only, those covered under the Anthem medical plan have access to the Anthem Blue View Vision network at NO COST. For additional exams and materials, employees will utilize the DeltaVision plan through the VSP network. Online Portal

Exam $10 Copay Glasses Lenses $25 Copay (Single / Bifocal/ Trifocal / Lenticular) Glasses Frames $130 Allowance Contact Lenses $130 Allowance (Medically Necessary / Elective)

Flexible Spending Accounts Watch This FSA Video to Learn 1 Flexible Spending Accounts (FSA) are set up to pay for many of out-of- More pocket medical expenses with tax-free dollars. The FSA account holder GENERAL sets aside a pre-tax dollar amount for the year used to pay for medical PURPOSE FSA expenses. Unused FSA funds can expire at the end of the year. 2025 IRS maximum for FSA is $3,300 and dependent care is $5,000. General Purpose FSA 1 An FSA is an alternative to an HSA. FSAs are typically paired with a PPO plan while an HSA is paired with an HDHP. HSA funds can 2 be used on various medical, dental, and vision related expenses. View Eligible Expenses DEPENDENT CARE ACCOUNT Dependent Care Account (DCA) 2 A DCA is a tax-free spending account for dependent care expenses such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. Learn More About Your DCA

Wellness Earn HSA Money CLINIC You can earn up to $650 in HSA contributions from Elkhart Community Schools. The Elkhart Schools clinic provides a broad scope of primary care services, comprehensive annual physicals, and health coaching at low or no cost, offers select labs at low or no cost, and prescribes high-quality generic drugs at low or no cost. Please call to schedule: (574) 262-5800 Clinic Hours: Monday 8 am – 6 pm Tuesday 7 am – 4 pm Wednesday 7 am – 4 pm Thursday 8 am – 6 pm Friday 7 am – 11 am

Additional BENEFITS Life insurance, AD&D, disability coverage , hospital indemnity and critical illness coverage available through New York Life.

Basic Life and AD&D Insurance Voluntary Life Insurance A life insurance policy is a contract with an insurance Employees have the option to purchase additional life company. In exchange for premium payments, the insurance. insurance company provides a lump-sum payment, Employee Benefit: Increments of $10,000 up to the lesser known as a death benefit, to beneficiaries upon the of 5x your basic annual earnings or $500,000. insured's death. Guaranteed Issue: $100,000 The rider covers the unintentional death or Spouse Benefit: Increments of $5,000 up to the lesser of dismemberment of the insured. Dismemberment $250,000 or 50% of Employee’s amount. includes the loss of, or the loss of use of body parts or Guaranteed Issue: $50,000 functions. The cost of this benefit is shared by ECS and employees Child(ren) Benefit: Increments of $1,000 up to $10,000 with employees paying 10% and ECS paying 90%. Guaranteed Issue: $10,000 Benefit Amount depends on Employee Class. (Children age 6 months to 26 years.)

Short-Term Disability Long-Term Disability Employee-paid short-term disability protects your The cost of this benefit is shared by ECS and employees with income during a short period of time due to illness, employees paying 10% and ECS paying 90%. maternity leave, or an accident not related to your job. Benefits begin 90 days after the date of the incident and will Benefits cover 60% of earnings up to $1,000 per week. cover 66.7% of earnings up to $7,500 per month Critical Illness Hospital Indemnity This insurance pays fixed cash benefits directly to This insurance pays benefits for a covered hospital stay you upon diagnosis of a covered critical illness after resulting from a covered injury or illness. Coverage the coverage effective date. These benefits can help continues after the first hospital stay so you have pay for out-of-pocket medical and non-medical additional protection for future hospital stays. expenses your medical insurance doesn’t cover. 24 Pay Periods 18 Pay Periods Employee Benefit: $10,000 or $20,000 Employee $9.85 $13.13 Rates vary by Employee Age Employee+Spouse $18.32 $24.43 Employee+Child(ren) $17.14 $22.85 Spouse Benefit:. $5,000 or $10,000 Family $25.61 $34.15 Children Benefit: $2,500 or $5,000

Employee Assistance Clinical Confidential assistance for a range of concerns including addictions, depression, anxiety, stress, PROGRAM relationships, and parenting. All full-time employees are automatically (even if you are not Wellness enrolled in medical benefits) provided access to New Avenue’s Telephone based wellness coaching for tobacco Employee Assistance Program. The EAP is a confidential cessation, weight loss management, fitness and resource available 24/7/365 to help you deal with a variety of exercise, stress management, parenting, and life stages and concerns. The program includes up to 4 relationship support. confidential consultations a year. Password: EAP Work-Life Assistance for daily challenges at home and work including financial, legal, child/elder care, and Get Help identity theft.