Goshen Community Schools 2025 Benefit Guide

January 1, 2025 - December 21, 2025

Goshen Community Schools Employee Benefits th nd 2025 Open Enrollment October 28 - November 22

Your 2025 Benefits The health and financial security of you and your family is important to us. Our benefit program provides a variety of plans that can enhance the lives of you and your family. We have added a second High Deductible Health Plan option for 2025 and made both PPO plans available to all eligible employees. Again, this year we’ll be utilizing The Worksite group for benefits enrollment. As a reminder, you have access to speak one-on-one with a licensed benefits counselor to review your options and complete your enrollment. Look for more information about this option. Whitney Dixon DIRECTOR OF FINANCE AND HR

Eligibility Employees Spouse & Legal Dependents Qualifying Events All employees working 15 hours per week, or more are Your children are eligible for medical, dental, and vision to You may make a change to your benefits if you have a eligible for the benefits program. You may insure age 26. Your children of any age are also eligible if you qualified status change such as: marriage yourself and eligible family members under the support them, and they are incapable of self-support due to divorce, birth/adoption, death, changes in spouse’s program. disability. As required by our insurance contracts, you may benefits, and more. be required to provide proof of eligibility for your dependents. If your dependent becomes ineligible for coverage during the year, you must contact your plan administrator within 30 days.

Employee Cost: Medical PPO PLAN A PPO PLAN B HDHP C HDHP D Goshen You Pay Goshen You Pay Goshen You Pay Goshen You Pay Goshen You Pay Goshen You Pay Goshen You Pay Goshen You Pay Pays (26 Pays) Pays (20 Pays) Pays (26 Pays) Pays (20 Pays) Pays (26 Pays) Pays (20 Pays) Pays (26 Pays) Pays (20 Pays) (26 Pays) (20 Pays) (26 Pays) (20 Pays) (26 Pays) (20 Pays) (26 Pays) (20 Pays) Employee $199.00 $119.36 $258.70 $155.17 $199.00 $94.72 $258.70 $123.14 $199.00 $99.95 $258.70 $129.93 $199.00 $69.11 $258.70 $89.84 ALL ELIGIBLE Employee + $438.27 $262.12 $569.75 $340.76 $438.27 $207.91 $569.75 $270.28 $438.27 $219.41 $569.75 $285.23 $438.27 $151.56 $569.75 $197.03 EMPLOYEES Spouse (Including Employee + 75/80/90/100 Child(ren) $356.94 $216.11 $464.03 $280.94 $356.94 $171.75 $464.03 $223.27 $356.94 $181.16 $464.03 $235.51 $356.94 $125.65 $464.03 $163.34 % Teachers) Goshen Goshen Total Goshen Goshen Total Goshen Goshen Total Goshen Goshen Total Family $630.55 $324.54 $819.71 $421.90 $630.55 $250.61 $819.71 $325.79 $630.55 $266.28 $819.71 $346.17 $630.55 $173.78 $819.71 $225.91 Schools Employee Cost Schools Employee Cost Schools Employee Cost Schools Employee Cost Pays Pays Pays Pays Pays Pays Pays Pays Employee $139.30 $179.06 $181.09 $232.78 $139.30 $154.42 $181.09 $200.75 $139.30 $159.65 $181.09 $207.54 $139.30 $128.81 $181.09 $167.45 Employee Only Employee + Employee Only Employee Only $9.88 $19.76 $30.00 Employee Only $9.88 $19.76 $30.00 $9.88 $19.76 $30.00 $9.88 $19.76 $30.00 40/50/60/70 Spouse $306.79 $393.60 $398.83 $511.68 $306.79 $339.39 $398.83 $441.21 $306.79 $350.89 $398.83 $456.15 $306.79 $283.05 $398.83 $367.96 % TEACHER Employee + Employee + Employee + Employee + Employee + $249.86 $278.83 $324.82 $362.48 $249.86 $323.19 $324.82 $420.15 $249.86 $288.24 $324.82 $374.71 $249.86 $232.73 $324.82 $302.55 Child(ren) $39.17 $78.34 $59.00 $39.17 $78.34 $59.00 Spouse $39.17 $78.34 $59.00 Spouse $39.17 $78.34 $59.00 Spouse Spouse Family $441.38 $513.70 $573.80 $667.81 $441.38 $439.77 $573.80 $571.70 $441.38 $455.45 $573.80 $592.08 $441.38 $362.94 $573.80 $471.83 Employee + Employee Employee + Employee + Employee + $28.66 $57.32 $49.00 $119.36 $155.17 $199.00 $94.72 $258.70 $123.14 $28.66 $57.32 $49.00 $199.00 $258.70 $229.68 $69.27 $298.58 $90.05 $229.68 $38.43 $298.58 $49.96 Child(ren) $28.66 $57.32 $49.00 Child(ren) $28.66 $57.32 $49.00 Child(ren) Child(ren) SUPPORT Employee + $438.27 $262.12 $569.75 $340.76 $438.27 $207.91 $569.75 $270.28 $438.27 $219.41 $569.75 $285.23 $438.27 $151.56 $569.75 $197.03 Family Spouse Family Family $53.62 $107.84 $74.00 Family $53.62 $107.84 $74.00 SCHOOL $53.62 $107.84 $74.00 $53.62 $107.84 $74.00 YEAR / SEC / Employee + $356.94 $216.11 $464.03 $280.94 $356.94 $171.75 $464.03 $223.27 $356.94 $181.16 $464.03 $235.51 $356.94 $125.65 $464.03 $163.34 BOOKKEEP Child(ren) Family $630.55 $324.54 $819.71 $421.90 $630.55 $250.61 $819.71 $325.79 $630.55 $266.28 $819.71 $346.17 $630.55 $173.78 $819.71 $225.91 Employee $304.51 $13.85 $395.87 $18.00 $284.49 $9.23 $369.83 $12.00 $294.33 $4.62 $382.63 $6.00 $267.65 $0.46 $347.94 $0.60 GOSHEN Employee + $686.55 $13.85 $892.51 $18.00 $636.95 $9.23 $828.04 $12.00 $653.06 $4.62 $848.98 $6.00 $589.38 $0.46 $766.19 $0.60 EMLOYEE Spouse MARRIED TO Employee + GOSHEN Child(ren) $559.20 $13.85 $726.97 $18.00 $519.46 $9.23 $675.30 $12.00 $533.49 $4.62 $693.53 $6.00 $482.13 $0.46 $626.77 $0.60 EMPLOYEE Family $941.24 $13.85 $1,223.61 $18.00 $871.92 $9.23 $1,133.50 $12.00 $892.22 $4.62 $1,159.88 $6.00 $803.87 $0.46 $1,045.03 $0.60

Employee Cost: Dental & Vision Dental Vision Goshen Pays You Pay Goshen Pays You Pay You Pay You Pay (26 Pays) (26 Pays) (20 Pays) (20 Pays) (26 Pays) (20 Pays) Employee $12.78 $4.87 $16.61 $6.33 Employee $2.53 $3.29 ALL ELIGIBLE Employee + $25.85 $7.06 $33.61 $9.18 Employee + $5.06 $6.58 EMPLOYEES Spouse ALL Spouse (Including Employee + EMPLOYEES Employee + 75/80/90/100% Child(ren) $27.92 $7.63 $36.29 $9.92 Child(ren) $5.42 $7.04 Teachers) Goshen Goshen Total Schools Employee Cost Family Pays Family Pays $42.78 $11.69 $55.61 $15.20 $8.65 $11.25 Employee Only Employee $8.82 $8.82 $11.47 $11.47 $9.88 $19.76 $30.00 Employee + $17.88 $15.04 $23.24 $19.55 Employee + Spouse 40/50/90/70% $39.17 $78.34 $59.00 Spouse TEACHER Employee + Employee + Child(ren) $19.31 $16.24 $25.10 $21.12 Child(ren) $28.66 $57.32 $49.00 Family $29.58 $24.88 $38.46 $32.35 Family Employee $53.62 $107.84 $74.00 $10.79 $6.85 $14.03 $8.91 Employee + $22.15 $10.77 $28.80 $13.99 SUPPORT SCHOOL Spouse YEAR / SEC / Employee + BOOKKEEP Child(ren) $23.92 $11.63 $31.10 $15.12 Family $36.65 $17.81 $47.65 $23.16

Pay and Deduction Calendar 26 Deduction 20 Deduction JANUARY FEBRUARY MARCH APRIL 1 2 3 4 1 1 1 2 3 4 5 5 6 7 8 9 10 11 2 3 4 5 6 7 8 2 3 4 5 6 7 8 6 7 8 9 10 11 12 12 13 14 15 16 17 18 9 10 11 12 13 14 15 9 10 11 12 13 14 15 13 14 15 16 17 18 19 19 20 21 22 23 24 25 16 17 18 19 20 21 22 16 17 18 19 20 21 22 20 21 22 23 24 25 26 26 27 28 29 30 31 23 24 25 26 27 28 23/ 24/ 25 29 27 28 29 27 28 29 30 30 31 MAY JUNE JULY AUGUST 1 2 3 1 2 3 4 5 6 7 1 2 3 4 5 1 2 4 5 6 7 8 9 10 8 9 10 11 12 13 14 6 7 8 9 10 11 12 3 4 5 6 7 8 9 11 12 13 14 15 16 17 15 16 17 18 19 20 21 13 14 15 16 17 18 19 10 11 12 13 14 15 16 18 19 20 21 22 23 24 22 23 24 25 26 27 28 20 21 22 23 24 25 26 17 18 19 20 21 22 23 25 26 27 28 29 30 31 29 30 27 28 29 30 31 24/ 25 26 27 28 29 30 31 SEPTEMBER OCTOBER NOVEMBER DECEMBER 1 2 3 4 5 6 1 2 3 4 1 1 2 3 4 5 6 7 8 9 10 11 12 13 5 6 7 8 9 10 11 2 3 4 5 6 7 8 7 8 9 10 11 12 13 14 15 16 17 18 19 20 12 13 14 15 16 17 18 9 10 11 12 13 14 15 14 15 16 17 18 19 20 21 22 23 24 25 26 27 19 20 21 22 23 24 25 16 17 18 19 20 21 22 21 22 23 24 25 26 27 28 29 30 26 27 28 29 30 31 23/ 24 25 26 27 28 29 28 29 30 31 30

Medical BENEFITS Log in to PlanSource to view your employee contributions. View Your Anthem Portal

All four plans are available to eligible employees. PPO PLAN A PPO PLAN B HDHP C HDHP D Embedded Deductible $600 / $1,200 $2,000 / $4,000 $3,300 / $6,600 $6,000 / $12,000 (Single/Family) Out-of-Pocket Max $3,000 / $6,000 $6,000 / $12,000 $3,300 / $6,600 $6,000 / $12,000 (Single/Family) Coinsurance 10% 20% 0% 0% Preventive Care 100% covered 100% covered 100% covered 100% covered Physician Office Visit $40 copay $40 copay Deductible + coinsurance Deductible + coinsurance Specialist Visit $45 copay $45 copay Deductible + coinsurance Deductible + coinsurance Emergency Room $100 copay + coinsurance $200 copay + coinsurance Deductible + coinsurance Deductible + coinsurance Urgent Care Centers $40 copay $40 copay Deductible + coinsurance Deductible + coinsurance Inpatient Services $150 copay + coinsurance $200 copay + coinsurance Deductible + coinsurance Deductible + coinsurance Outpatient Services Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Out-of-network benefits: PPO A out-of-pocket max is $5,000 / $9,000 and PPO B out-of-pocket max is $10,000 / $20,000. Coinsurance for Plans A & B is 30%. No coinsurance for Plans C & D

Anthem’s Sydney Health App Telehealth Use Anthem’s Sydney app to connect with a board-certified doctor through video visits or have a virtual chat visit for no or low cost, depending on your plan. Watch Sydney Health App Video Manage Your Claims With Sydney Health, you can submit and track your claims, anytime, anywhere. Compare Care & Costs Our digital tools can help you find doctors in your plan’s network and compare care costs up front. Access Your ID Card Download the App Your digital ID card is always with you when you need it.

Inspiring Innovation… Empowering Potential… Enriching our World.

Prescription DRUGS Your pharmacy plan is through NAVITUS. View Your Navitus Portal

PPO PLAN A PPO PLAN B HDHP C HDHP D Retail Prescriptions: Greater of $10 or 15% $10 copay Deductible + coinsurance Deductible + coinsurance Tier 1: Generic Retail Prescriptions: Greater of $40 or 40% Greater of $40 or 40% Deductible + coinsurance Deductible + coinsurance Tier 2: Formulary Retail Prescriptions: Greater of $60 or 60% Greater of $60 or 60% Deductible + coinsurance Deductible + coinsurance Tier 3: Non-Formulary Retail Prescriptions: 10% of prescription cost after 20% of prescription cost after Deductible + coinsurance Deductible + coinsurance Specialty deductible deductible Mail Order Prescriptions: 10% 10% of cost Deductible + coinsurance Deductible + coinsurance Tier 1: Generic Mail Order Prescriptions: Greater of $40 or 40% Greater of $40 or 40% Deductible + coinsurance Deductible + coinsurance Tier 2: Formulary Mail Order Prescriptions: Greater of $60 or 60% Greater of $60 or 60% Deductible + coinsurance Deductible + coinsurance Tier 3: Non-Formulary Mail Order Prescriptions: 10% of prescription cost 20% of prescription cost Deductible + coinsurance Deductible + coinsurance Specialty Out-of-Network Plan A & B Retail prescriptions: copay + difference in cost. Specialty prescriptions: same in or out of network. Mail order: not covered. Out-of-Network Plan C and D not covered.

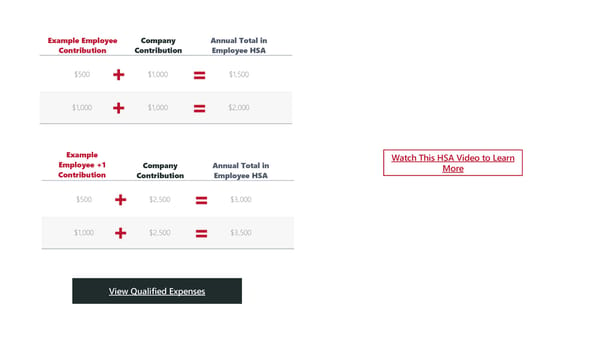

Health Savings ACCOUNT A Health Savings Account (HSA) is available to those enrolled in a Company contribution up to High Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses all tax-free. Any unused earnings rollover from year-to-year. Goshen Community Schools will contribute $2,500 $1,000 annually for individuals and $2,500 for families. The IRS max contribution is $4,300 for individuals and $8,550 and for families.

Example Employee Company Annual Total in Contribution Contribution Employee HSA $500 + $1,000 = $1,500 $1,000 + $1,000 = $2,000 Example Watch This HSA Video to Learn Employee +1 Company Annual Total in More Contribution Contribution Employee HSA $500 + $2,500 = $3,000 $1,000 + $2,500 = $3,500 View Qualified Expenses

HDHP and HSA Consumer Experience Doctor Visit Amount Owed EOB Bill Received Pay with HSA Visit your healthcare provider and The health plan will share the The health plan send you the Your doctor will then send you You can use your HSA funds the office will submit the claim to amount you owe with your Explanation of Benefits (EOB). a bill. to pay the bill from your your health plan. doctor. doctor.

Set Up Your HSA Account Complete the Form Download and complete the HSA set-up form with Interra Credit Union. Fax or mail the form to the contact information located at the bottom of the PDF. Download the Form Open an Account Call Interra at (574) 534-2506 or (888) 432-2848 to open your account once the set-up form has been completed and submitted. Share Your Account Number Once your account is open, notify the Goshen benefits team with your Interra-provided account number so that contributions can begin.

DENTAL DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 317-842-4022 Dental Coverage with KRISTEN JONES Group Delta Dental Delta Dental PPO Delta Dental offer three levels of benefits coverage; PPO Dentist, Premier Dentist, and Non-Participating Dentist. Find providers, view your ID card, and more online or using the mobile app. Online Portal Download the App

Deductible (Single / Family) $50 / $150 Annual Plan Maximum $1,500 Preventive Services 100% Covered Exams, Cleanings, Fluoride, X-Rays Basic Services 80% Covered Fillings, Extractions, Endodontics, Crown Repairs Major Services 80% Covered Crowns, Dentures, In/Outlays, Periodontics Delta Dental offers three levels of benefit coverage: PPO Dentist, Premier Dentist, and Non-Participating Dentist. Review summary of benefits for more details.

VISION Delta Vision through the VSP Network Your vision insurance is through Delta Vision which utilizes the VSP network. Online Portal

IN NETWORK OUT-OF-NETWORK Routine Exam $10 copay $45 allowance $30 allowance single vision Lenses $25 copay $50 allowance Bifocal $65 allowance Trifocal Frames $130 allowance $70 allowance Elective Contacts $130 allowance $105 allowance Necessary Contacts 100% covered $210 allowance Each material benefit is paid out once every 12 months, frames every 24 months.

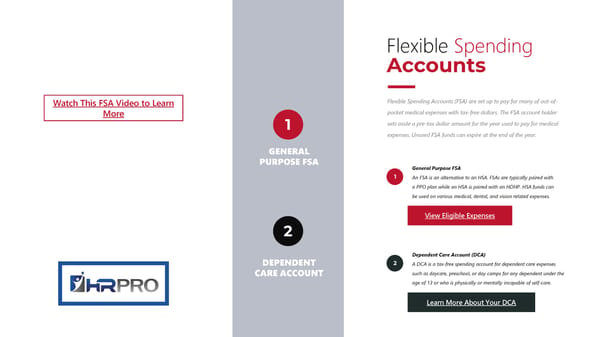

Flexible Spending Accounts Watch This FSA Video to Learn Flexible Spending Accounts (FSA) are set up to pay for many of out-of- More pocket medical expenses with tax-free dollars. The FSA account holder 1 sets aside a pre-tax dollar amount for the year used to pay for medical expenses. Unused FSA funds can expire at the end of the year. GENERAL PURPOSE FSA General Purpose FSA 1 An FSA is an alternative to an HSA. FSAs are typically paired with a PPO plan while an HSA is paired with an HDHP. HSA funds can be used on various medical, dental, and vision related expenses. View Eligible Expenses 2 Dependent Care Account (DCA) DEPENDENT 2 A DCA is a tax-free spending account for dependent care expenses CARE ACCOUNT such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. Learn More About Your DCA

Additional BENEFITS Goshen Community Schools offers additional employer-paid and employee-paid benefits for you and your family. Reliance Standard is the partner for all basic and voluntary term life, short and long- term disability, accident, and critical illness insurance. Online Portal

Employer-Paid Voluntary Term Life Insurance Basic Life and AD&D Employees have the option to purchase additional life insurance. The group life and accident, death, and dismember policy is Evidence of Insurability is required for new enrollments in the available to all full-time employees and is 100% employer- plans or increases in benefit amount. paid in the event of death, loss of (or loss of use of) a body Employee Benefit: Increments of $10,000 up to $500,000. part or function, speech, eyesight, or hearing. Guarantee issue of $200,000. Click here to view eligibility, benefits, guarantee issue, and more. Spouse Benefit: Increments of $5,000 up to $250,000. Child(ren) Benefit: Increments of $2,000 up to $10,000. Click here to view premium tables and highlight sheets. Voluntary Short-Term Disability Employer-Paid Long-Term Short-term disability is 100% employee paid and protects Disability your income during a short period of time due to illness Long-term disability is 100% employer paid and protects or an accident not related to your job. Benefits begin on your income for an extended period of time. Benefits begin the 15th day after the date of the incident and the policy on the 91st day after the date of the incident and will cover will pay 60% of your weekly salary for 13 weeks. Click here 67% of your earnings. Click here to view highlight sheets. to view premium tables and highlight sheets.

Voluntary Accident Voluntary Whole Life Employees have the option to purchase accident Allstate Benefits Whole Life coverage provides a lump sum insurance to cover a variety of occurrences, such as: death benefit during life changing events such as the death dismemberment; dislocation or fracture; ambulance of a wage earner. Our Group Whole Life policy offers services; physical therapy; and more. Click to view coverage amounts from a minimum of $5,000 to a maximum benefits, amounts, and premiums. of $100,000. Voluntary Critical Illness Whole Life can be valuable as another way to buy up to Critical illness insurance protects you and your family if $100,000 in additional guaranteed life insurance. Click to diagnosed with a critical illness. learn more about how it works, long-term rider care, and Click to view coverage benefit amounts and premiums. amounts and benefit premiums based on age. Click to view premiums and highlight sheets. Protect yourself and your loved ones (under your roof or under your wallet) from identity theft and fraud with Privacy Identity Armor from Allstate. Privacy Armor provides 24/7 monitoring, alerts, fee reimbursements incurred from identity theft, Theft and more. 20-pay premiums are $5.97 for single coverage and $10.77 for families. 26-pay premiums are $4.60 for single coverage and $8.29 for families. Learn more at app.allstateidentityprotection.com/signin/login

Employee Clinical Assistance Confidential assistance for a range of concerns including addictions, depression, anxiety, stress, PROGRAM relationships, and parenting. The Employee Assistance Program (EAP) is available to you and Wellness your family from Telus Health (formerly LifeWorks). You, your Telephone based wellness coaching for tobacco dependents (children between ages 13-26) and all household cessation, weight loss management, fitness and members can contact a professional clinician 24/7/365 by exercise, stress management, parenting, and phone, live chat or text. relationship support. Your family has access to up to three (3) in-person or virtual assessment and short-term problem resolution services per Work-Life presenting problem. Assistance for daily challenges at home and work Get Help including financial planning, legal, child/elder care, and identity theft.

PlanSource Get Enrolled Today! st User: Fname Initial + 1 6 letters of Lname + last 4 digits of SSN Example: John Employee, SSN 123-45-6789 = JEmploy6789 Password: Birthday in format of YYYYMMDD Enroll Online Questions about your benefits? The Worksite Group can help! Speak one-on-one with a licensed benefits counselor to review your options and complete your enrollment entirely over the phone. Schedule an Appointment