Mt. Vernon Community School Corporation Benefit Guide

2025 Employee Benefits: 1/1/25-12/31/25

2025 Open Enrollment November 12th – 22nd Mt. Vernon Employee Benefits

Jennifer Thomas Onboarding & Benefits Specialist [email protected] Your 2025 Benefits At Mt. Vernon Community School Corporation, staff are provided professional development opportunities and tools for an effective learning environment, making MVCSC the central region's #1 place to teach. We offer rewarding career opportunities in Hancock County, where both students and staff are able to succeed and thrive in their definition of success. Watch Video

Employees All full-time employees working at least 30 hours per week, or more are eligible for the benefits program. You may insure yourself and eligible family members under the program. Spouse & Legal Dependents Your children are eligible for medical, dental, and vision to age 26. Your children of any age are also eligible if they are incapable of self-support due to a disability. Qualifying Events You may make a change to your benefits if you have a qualified status change such as: marriage divorce, birth/adoption, death, changes in spouse’s benefits, and more. Eligibility

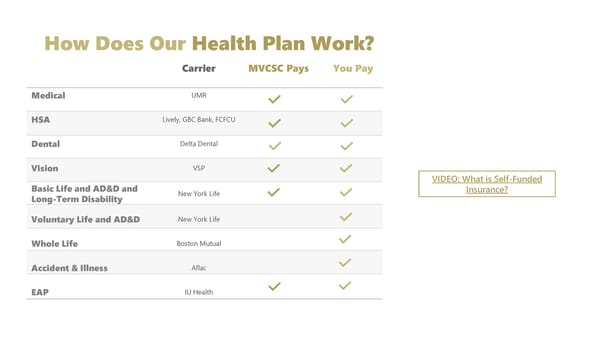

VIDEO: What is Self-Funded Insurance? How Does Our Health Plan Work? Carrier MVCSC Pays You Pay Medical UMR HSA Lively, GBC Bank, FCFCU Dental Delta Dental Vision VSP Basic Life and AD&D and Long-Term Disability New York Life Voluntary Life and AD&D New York Life Whole Life Boston Mutual Accident & Illness Aflac EAP IU Health

Employee Cost MEDICAL Coverage through UMR PPO PLAN HSA PLAN ONE HSA PLAN TWO 26 Pays 20 Pays 26 Pays 20 Pays 26 Pays 20 Pays Employee Only $83.17 $108.12 $57.27 $74.45 $35.35 $45.95 Employee + Spouse $237.66 $308.95 $174.03 $226.24 $84.51 $109.86 Employee + Child(ren) $203.70 $264.82 $149.03 $193.73 $72.43 $94.16 Family $367.20 $477.36 $276.48 $359.43 $120.72 $156.94

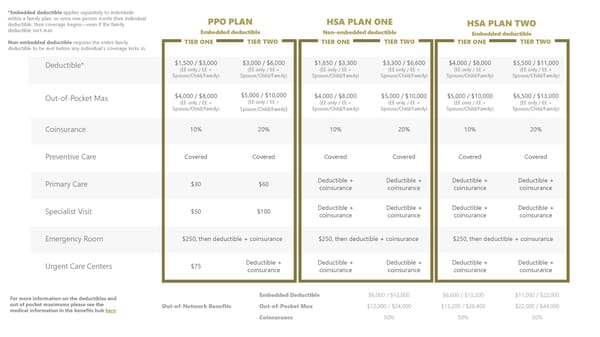

Medical BENEFITS For 2025, your benefits are moving from Anthem to UMR with one PPO plan option and two high deductible health plan options with an HSA.

Deductible* $1,500 / $3,000 (EE only / EE + Spouse/Child/Family) $3,000 / $6,000 (EE only / EE + Spouse/Child/Family) $1,650 / $3,300 (EE only / EE + Spouse/Child/Family) $3,300 / $6,600 (EE only / EE + Spouse/Child/Family) $4,000 / $8,000 (EE only / EE + Spouse/Child/Family) $5,500 / $11,000 (EE only / EE + Spouse/Child/Family) Out-of-Pocket Max $4,000 / $8,000 (EE only / EE + Spouse/Child/Family) $5,000 / $10,000 (EE only / EE + Spouse/Child/Family) $4,000 / $8,000 (EE only / EE + Spouse/Child/Family) $5,000 / $10,000 (EE only / EE + Spouse/Child/Family) $5,000 / $10,000 (EE only / EE + Spouse/Child/Family) $6,500 / $13,000 (EE only / EE + Spouse/Child/Family) Coinsurance 10% 20% 10% 20% 10% 20% Preventive Care Covered Covered Covered Covered Covered Covered Primary Care $30 $60 Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Specialist Visit $50 $100 Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Emergency Room $250, then deductible + coinsurance $250, then deductible + coinsurance $250, then deductible + coinsurance Urgent Care Centers $75 Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance Deductible + coinsurance PPO PLAN Embedded deductible TIER ONE TIER TWO HSA PLAN ONE Non-embedded deductible TIER ONE TIER TWO HSA PLAN TWO Embedded deductible TIER ONE TIER TWO Out-of-Network Benefits Embedded Deductible $6,000 / $12,000 $6,600 / $13,200 $11,000 / $22,000 Out-of-Pocket Max $12,000 / $24,000 $13,200 / $26,400 $22,000 / $44,000 Coinsurance 50% 50% 50% *Embedded deductible applies separately to individuals within a family plan, so once one person meets their individual deductible, their coverage begins—even if the family deductible isn't met. Non-embedded deductible requires the entire family deductible to be met before any individual’s coverage kicks in. For more information on the deductibles and out of pocket maximums please see the medical information in the benefits hub here

Store & Easily Access Virtual ID Cards 1 2 3 Manage Claims for You & Your Dependents Track Your Deductible & Out-of-Pocket Max Totals 4 Find In-Network Providers UMR Mobile App & Desktop Portal View Your UMR Portal Download the UMR App

Prescription DRUGS TrueScripts provides you with personalized support to help you manage and reduce your prescription drug costs. You can contact TrueScripts whenever you have questions or need help navigating your pharmacy benefits. View recent claims, find a pharmacy, check drug prices and more. Call 844-257-1955 or visit the portal below. TrueScripts Member Portal

Retail Prescriptions: Tier 1: Generic $35 $35 after deductible 0% after deductible Retail Prescriptions: Tier 2: Preferred $65 $65 after deductible 0% after deductible Retail Prescriptions: Tier 3: Non-Preferred $100 $100 after deductible 0% after deductible Retail Prescriptions: Tier 4: Specialty $200 $200 after deductible 0% after deductible Mail Order Prescriptions: Tier 1: Generic $70 $70 after deductible 0% after deductible Mail Order Prescriptions: Tier 2: Preferred $130 $130 after deductible 0% after deductible Mail Order Prescriptions: Tier 3: Non-Preferred $200 $200 after deductible 0% after deductible Mail Order Prescriptions: Tier 4: Specialty $400 $400 after deductible 0% after deductible PPO PLAN HSA PLAN ONE HSA PLAN TWO Out-of-Network prescriptions are not covered.

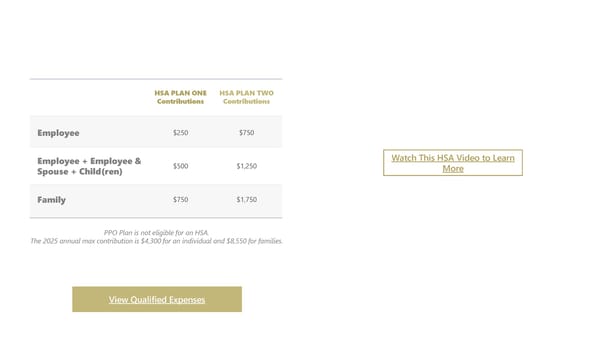

Health Savings ACCOUNT A Health Savings Account (HSA) is available to those enrolled in a High Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses all tax-free. Any unused earnings rollover from year-to-year. MVCSC contribution up to $1,750

We are updating our Health Savings Account (HSA) offerings to streamline your experience. Beginning in 2025 you will need to open an HSA account with Lively, GBC Bank or Financial Center First Credit Union (unless you already have one with one of these three vendors). Mt. Vernon Community School Corporation will only be able to payroll deduct contributions into accounts at these three institutions. If you choose to keep your current HSA account at a different institution, your existing funds will remain available, but no new contributions will be directed to that account. When you select one of these three new institutions, you can either roll over your existing HSA funds or start fresh, while continuing to use the old account until it's empty. Next Steps: 1. Review Vendor Options: Explore Financial Center First Credit Union, Lively, and GBC Bank to find the best fit for your needs. 2. Make Your Selection: Choose your new HSA vendor for future contributions, then decide whether to keep your old HSA until it’s empty or roll them over to your new account. 3. Set Up Your New Account: Contact your selected new vendor to set up your account and, if applicable, arrange for a rollover of existing funds. 4. Update Payroll Information: Ensure your payroll deductions are updated to reflect your new HSA vendor. HSA CHANGES Lively A modern HSA platform providing intuitive online tools, no hidden fees, and the flexibility to invest your HSA funds. Visit their website > Financial Center First Credit Union A trusted local credit union offering personalized HSA management with competitive rates and easy access to accounts. Visit their website > GBC Bank A regional bank that offers comprehensive HSA services, including convenient online banking and investment options. Visit their website >

View Qualified Expenses Watch This HSA Video to Learn More PPO Plan is not eligible for an HSA. The 2025 annual max contribution is $4,300 for an individual and $8,550 for families. HSA PLAN ONE Contributions HSA PLAN TWO Contributions Employee $250 $750 Employee + Employee & Spouse + Child(ren) $500 $1,250 Family $750 $1,750

Doctor Visit Visit your healthcare provider and the office will submit the claim to your health plan. Amount Owed The health plan will share the amount you owe with your doctor. EOB The health plan send you the Explanation of Benefits (EOB). Bill Received Your doctor will then send you a bill. HSA Consumer Experience Pay with HSA You can use your HSA funds to pay the bill from your doctor.

DENTAL Delta Dental offer three levels of benefits coverage; PPO Dentist, Premier Dentist, and Non-Participating Dentist. Find providers, view your ID card, and more online or using the mobile app. PPO Coverage - Offers significant discounts; no balance billing; acceptance of processing policies; and 108,000 dentist locations Premier Coverage - Negotiated fees; no balance billing; acceptance of processing policies; and 186,000 dentist locations Non-Participating Coverage - Balance billing and does not offer discounts Dental Coverage with Delta Dental DELTA DENTAL OF INDIANA 225 S East St Indianapolis, IN 46202 317-842-4022 KRISTEN JONES Group Delta Dental PPO Online Portal Download the App

Deductible $25 / person to a max of $75 / family Annual Plan Maximum $1,000 / person Diagnostic Preventive Services Exams, Cleanings, Fluoride, and space maintainers You Pay 0% Basic Services X-rays, filings/crown repair, root canals, extractions, crowns, relines/repairs to bridges, implants and dentures You Pay 50% Major Services Prosthodontic Services: bridges, implants and dentures You Pay 50% Orthodontia Services You Pay 50% Orthodontia Lifetime Maximum $500 PPO Coverage - Offers significant discounts; no balance billing; acceptance of processing policies; and 108,000 dentist locations Premier Coverage - Negotiated fees; no balance billing; acceptance of processing policies; and 186,000 dentist locations Non-Participating Coverage - Balance billing and does not offer discounts

VISION Vision coverage with VSP Vision Care Network Online Portal

Materials copay is $10 applied to lenses and frames. Exams, Lenses, contacts are paid out every calendar year. Frames are paid out every 24 months. Exam $10 copay $42 allowance Glasses Lenses (Single / Bifocal/ Trifocal) $0 copay $40 allowance $60 allowance $80 allowance Glasses Frames $10 copay $140 allowance 20% discount on remaining $45 allowance Contact Lenses (Medically Necessary / Elective) Covered in full / $120 allowance $210 allowance / $105 allowance IN NETWORK OUT-OF-NETWORK

4 Ways to SAVE ON HEALTHCARE $ AVOID THE ER FOR TRUE EMERGENCIES DON’T HESITATE TO CALL 911 OR GO TO THE EMERGENCY ROOM. WHEN POSSIBLE, UTILIZING A WALK-IN CLINIC OR URGENT CARE WILL SAVE YOU TIME AND MONEY FOR THE SAME SERVICES. $$ CUT Rx COST COMPARE DRUG PRICES & TALK TO YOUR DOCTOR ABOUT LOWER COST OPTIONS. UTILIZE COUPONS & SERVICES LIKE GOODRx, Rx HELP CENTERS, OR THE COSTPLUS DRUG COMPANY. $$$ SHOP AROUND UTILIZE THE UMR PORTAL TO FIND THE BEST CARE AT THE BEST PRICE. LAB WORK & IMAGING SERVICES LIKE ULTRASOUNDS, X-RAYS, CT SCANS, BLOOD DRAWS, ETC. ARE COSTLY. RESEARCH PROVIDERS BEFORE YOU MAKE AN APPT. $$$$ STAY HEALTHY LIVE A HEALTHY LIFESTYLE THROUGH REGULAR MOVEMENT & HEALTHY EATING HABITS. REGULARLY VISIT YOUR PRIMIARY CARE PHYSICIAN. SCHEDULE YOUR ANNUAL PHYSICAL & PREVENTIVE CARE APPOINTMENTS.

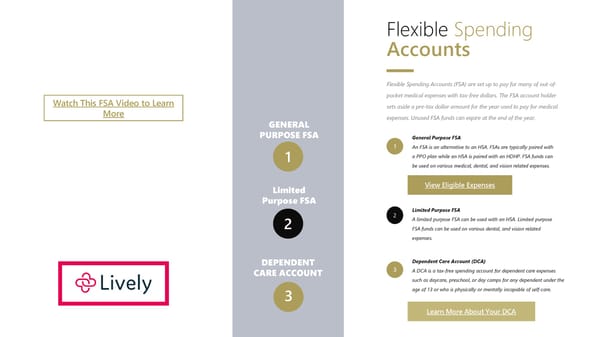

GENERAL PURPOSE FSA DEPENDENT CARE ACCOUNT Flexible Spending Accounts Flexible Spending Accounts (FSA) are set up to pay for many of out-of- pocket medical expenses with tax-free dollars. The FSA account holder sets aside a pre-tax dollar amount for the year used to pay for medical expenses. Unused FSA funds can expire at the end of the year. 1 General Purpose FSA An FSA is an alternative to an HSA. FSAs are typically paired with a PPO plan while an HSA is paired with an HDHP. FSA funds can be used on various medical, dental, and vision related expenses. 2 Watch This FSA Video to Learn More 1 2 View Eligible Expenses Learn More About Your DCA 2 3 Limited Purpose FSA A limited purpose FSA can be used with an HSA. Limited purpose FSA funds can be used on various dental, and vision related expenses. Dependent Care Account (DCA) A DCA is a tax-free spending account for dependent care expenses such as daycare, preschool, or day camps for any dependent under the age of 13 or who is physically or mentally incapable of self-care. 3 Limited Purpose FSA

Additional BENEFITS Mt. Vernon Community Schools Corporation provides full- time employees with basic life insurance and disability income protection at a low employee cost.

Basic Life and AD&D The employer-paid basic life and accidental death & dismemberment insurance policy is available to all full-time employees. Visit Steele Benefits system or talk to HR for full details on this benefit and coverage. Long-Term Disability Employer-paid long-term disability protects your income for a period of time due to illness, maternity leave, or an accident not related to your job. Benefits are payable after 90 days of disability. Your benefit amount is 66.7% of your monthly earnings. Max benefit is based on employment class. Free Financial Coaching Your Money Line provides expert guidance and tools to help you on your unique financial journey. Net worth calculator, budgeting, debt reduction, college aid coach, help with bills, investment courses, and more. Register at yourmoneyline.com/mvcs, call 833.890.4077, or email [email protected] Basic Life and AD&D, Long-Term Disability, and financial coaching benefits are open at no cost to full time employees.

Critical Care Insurance Aflac critical illness coverage offers money to help you focus on recovery in the event of serious illness. Benefit features include coverage for the employee, their spouse and their children and the ability to customize the benefit volume. Employees and spouses are covered for $20,000 and their children for $5,000-$10,000. Accident Insurance Aflac accident insurance helps pay for unexpected expenses due to accidents that occur every day—From the soccer field to the ski slopes and the highway in between. This insurance provides benefits due to covered accidents for initial care, injuries and follow-up care. Whole Life Insurance Boston Mutual whole life insurance offers protection beyond your working years. It combines guaranteed premiums, death benefits, and cash accumulation. With whole life insurance you choose the amount of insurance or the amount of premium that best suits your need and budget. Employees have the option to purchase additional life insurance. Employee Benefit: Increments of $10,000 up to $500,000. Guarantee issue of $200,000. Spouse Benefit: Increments of $5,000 up to $250,000. Guarantee issue of $25,000. Child(ren) Benefit: Up to $10,000. Guarantee issue of $10,000. Voluntary Life and AD&D Critical, Accident, and Whole Life, and Voluntary Life and AD&D are voluntary benefits open to all employees.

Health & Wellness CLINIC Learn More & Book an Appt Primary Care Primary health care services including sick visits, care for chronic illness, free lab tests, and blood work. Free Medicine Medicine prescribed by the clinic provides and available at the clinic is at no charge for MVCS employees and covered dependents participating in our medical plan. Virtual Visits Virtual appointment slots are available on Fridays from 12:00 p.m. to 3:00 p.m. Hancock Family Practice New Palestine (Chelsea Lock, NP) 4055 Roy Wilson Way, Ste. 110, New Palestine, IN 46163 MVCSC Employee Clinic next to the Hancock Health Wellness Center 8535 N. Clearview Drive, Ste. 700 (enter door #1), McCordsville, IN 46055 Hancock Well-Being At Work Gateway/Mount Comfort Rd. (Chelsea Lock, NP) 6189 John L. Modglin Drive, Suite 202, Greenfield, IN 46140 Hancock Well-Being At Work Greenfield (Lori Deemer, MD) 1515 North State Street, Greenfield, IN 46140

You and your household members have access to IU Health Employee Assistance Program (EAP) to help with the everyday challenges of life that may affect your health, family life and desire to excel at work. IU Health’s EAP provides resources to assist with personal and job-related issues. You and your eligible family members can access eight face-to-face, confidential sessions with a counselor, financial planner, or attorney each calendar year. 8:00am – 4:30pm EST Monday - Friday Employee Assistance PROGRAM Call 317-962-8001 or 800-745-4838x2 Mental Health Counseling Provides confidential, short-term counseling services to help employees manage stress, anxiety, depression, and other mental health concerns. Legal Assistance Offers access to legal professionals for consultations and guidance on personal legal matters such as family law, estate planning, and landlord-tenant disputes. Financial Wellness Provides financial counseling and resources to help employees manage budgeting, debt, savings, and overall financial well-being.

ENROLL ONLINE You will use the Steele Benefits enrollment platform to make New Hire and/or Open Enrollment elections, view your current elections, make life event changes, update family and/or beneficiary information, access benefit materials, and more. Looking for one- on-one enrollment help? Call Steele Benefits at 574-821-6025. Enroll Online Required Dependent Information In order to enroll your dependents in benefits, be sure to have the following information available: Full Name, Date of Birth, Social Security Number and Address (if different than yours). 1. Open a web browser and navigate to aflacatwork.com/enroll. 2. Enter the following information: User name: Full SSN with no spaces or dashes Pin Number: The Last 4 digits of your SSN + Last 2 of your birth year 3. Click the Log In Button 4. Click Next to start your enrollment 5. Enter your dependents by selecting the plus(+) sign 6. Follow the prompts to enroll in each benefit and click the Next button to navigate through the screens 7. Once you are enrolled, you will see your confirmation page where you will enter your PIN Number to confirm your elections. 8. Congratulations! You have successfully enrolled! You will receive an email copy of your confirmation page