Online Transport 2025 Benefit Guide

2025 Open Enrollment Your Benefits Plan

Your 2025 Benefits The health and financial security of our employees is important to us. Our benefits program provides a variety of plans that can enhance the lives of you and your family – both now and in the future. As an eligible employee, you will be asked to make decisions about the employee benefits described in this guide. This guide provides information to enable you to effectively enroll in your benefits. Take time to carefully read the guide and use the available resources to ensure you make decisions that are right for you and your family.

Employees Online Transport is proud to offer a comprehensive benefits package to those employees working 30 or more hours per week. For new hires, medical and dental benefits begin the day following 90 days of employment. Vision, life and disability coverages begin the 1st of the month following 90 days of employment. Spouse & Legal Dependents You may insure yourself, your spouse, and eligible children (until age 26) under the program. If your spouse is employed and your spouse’s employer provides a medical plan for which your spouse is eligible, you will experience an additional $25 surcharge per pay if you elect to cover your spouse under the Online Transport plan. Qualifying Events Employees may add/remove/make benefit changes during the Open Enrollment period which is held annually. However, we understand that life happens. Employees have 31 days from the date of the qualified life event to make changes/updates. Examples of qualified life events are: birth or adoption of a child; marriage or divorce; death; loss of coverage or eligibility for other coverage; and employment status changes. Eligibility

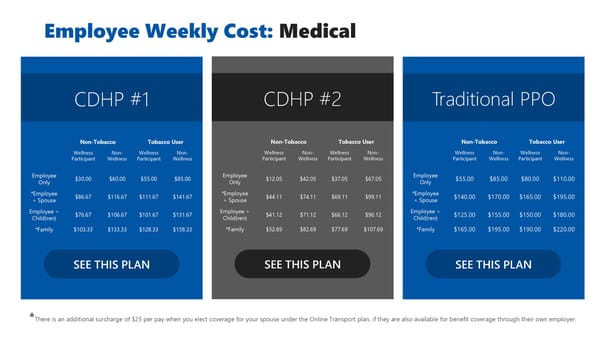

Employee Weekly Cost: Medical CDHP #2 SEE THIS PLAN CDHP #1 SEE THIS PLAN Non-Tobacco Tobacco User Wellness Participant Non- Wellness Wellness Participant Non- Wellness Employee Only $30.00 $60.00 $55.00 $85.00 *Employee + Spouse $86.67 $116.67 $111.67 $141.67 Employee + Child(ren) $76.67 $106.67 $101.67 $131.67 *Family $103.33 $133.33 $128.33 $158.33 Traditional PPO SEE THIS PLAN Non-Tobacco Tobacco User Wellness Participant Non- Wellness Wellness Participant Non- Wellness Employee Only $12.05 $42.05 $37.05 $67.05 *Employee + Spouse $44.11 $74.11 $69.11 $99.11 Employee + Child(ren) $41.12 $71.12 $66.12 $96.12 *Family $52.69 $82.69 $77.69 $107.69 Non-Tobacco Tobacco User Wellness Participant Non- Wellness Wellness Participant Non- Wellness Employee Only $55.00 $85.00 $80.00 $110.00 *Employee + Spouse $140.00 $170.00 $165.00 $195.00 Employee + Child(ren) $125.00 $155.00 $150.00 $180.00 *Family $165.00 $195.00 $190.00 $220.00 *There is an additional surcharge of $25 per pay when you elect coverage for your spouse under the Online Transport plan, if they are also available for benefit coverage through their own employer.

Employee Weekly Cost: Dental & Vision VISION SEE THIS PLAN DENTAL SEE THIS PLAN Employee Only $5.01 Employee + Spouse $10.54 Employee + Child(ren) $12.24 Family $17.03 Employee Only $1.94 Employee + Spouse $3.27 Employee + Child(ren) $3.33 Family $5.38

Medical BENEFITS UMR has negotiated discounts with a large national network of doctors and hospitals named United Healthcare Choice Plus. You will enjoy the highest level of benefits and the greatest value if you choose to receive care through the Choice Plus Network of providers. View Your UMR Portal

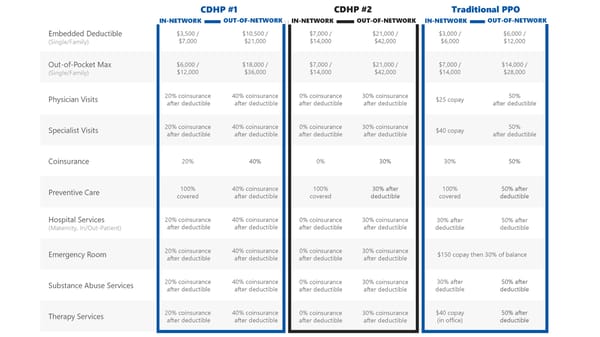

Embedded Deductible (Single/Family) $3,500 / $7,000 $10,500 / $21,000 $7,000 / $14,000 $21,000 / $42,000 $3,000 / $6,000 $6,000 / $12,000 Out-of-Pocket Max (Single/Family) $6,000 / $12,000 $18,000 / $36,000 $7,000 / $14,000 $21,000 / $42,000 $7,000 / $14,000 $14,000 / $28,000 Physician Visits 20% coinsurance after deductible 40% coinsurance after deductible 0% coinsurance after deductible 30% coinsurance after deductible $25 copay 50% after deductible Specialist Visits 20% coinsurance after deductible 40% coinsurance after deductible 0% coinsurance after deductible 30% coinsurance after deductible $40 copay 50% after deductible Coinsurance 20% 40% 0% 30% 30% 50% Preventive Care 100% covered 40% coinsurance after deductible 100% covered 30% after deductible 100% covered 50% after deductible Hospital Services (Maternity, In/Out-Patient) 20% coinsurance after deductible 40% coinsurance after deductible 0% coinsurance after deductible 30% coinsurance after deductible 30% after deductible 50% after deductible Emergency Room 20% coinsurance after deductible 40% coinsurance after deductible 0% coinsurance after deductible 30% coinsurance after deductible $150 copay then 30% of balance Substance Abuse Services 20% coinsurance after deductible 40% coinsurance after deductible 0% coinsurance after deductible 30% coinsurance after deductible 30% after deductible 50% after deductible Therapy Services 20% coinsurance after deductible 40% coinsurance after deductible 0% coinsurance after deductible 30% coinsurance after deductible $40 copay (in office) 50% after deductible CDHP #1 CDHP #2 Traditional PPO OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK

Store & Easily Access Virtual ID Cards 1 2 3 Manage Claims for You & Your Dependents Track Your Deductible & Out-of-Pocket Max Totals 4 Find In-Network Providers UMR Mobile App & Desktop Portal View Your UMR Portal Download the UMR App

24/7 Virtual Doctor Visits 24/7 access to U.S. licensed doctors by phone or video Doctors can diagnose, treat, & prescribe medication Quality care from wherever you are Register or Schedule Online Download the App

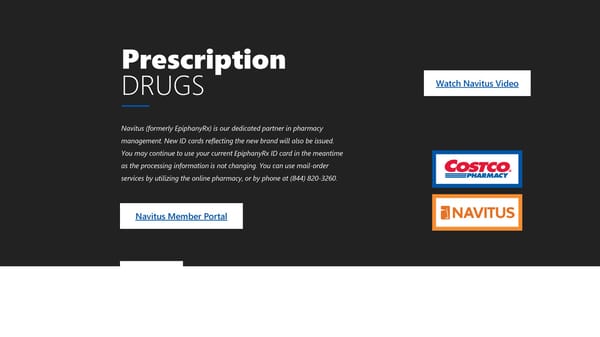

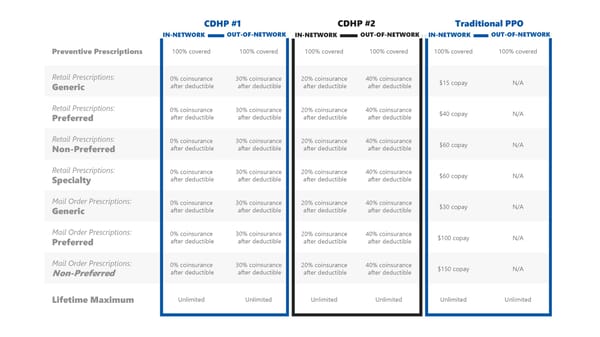

Prescription DRUGS Navitus (formerly EpiphanyRx) is our dedicated partner in pharmacy management. New ID cards reflecting the new brand will also be issued. You may continue to use your current EpiphanyRx ID card in the meantime as the processing information is not changing. You can use mail-order services by utilizing the online pharmacy, or by phone at (844) 820-3260. Navitus Member Portal Watch Navitus Video

Preventive Prescriptions 100% covered 100% covered 100% covered 100% covered 100% covered 100% covered Retail Prescriptions: Generic 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $15 copay N/A Retail Prescriptions: Preferred 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $40 copay N/A Retail Prescriptions: Non-Preferred 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $60 copay N/A Retail Prescriptions: Specialty 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $60 copay N/A Mail Order Prescriptions: Generic 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $30 copay N/A Mail Order Prescriptions: Preferred 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $100 copay N/A Mail Order Prescriptions: Non-Preferred 0% coinsurance after deductible 30% coinsurance after deductible 20% coinsurance after deductible 40% coinsurance after deductible $150 copay N/A Lifetime Maximum Unlimited Unlimited Unlimited Unlimited Unlimited Unlimited CDHP #1 CDHP #2 Traditional PPO OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK

Health Savings ACCOUNT A Health Savings Account (HSA) is available to those enrolled in a High Deductible Health Plan. HSA funds can be used for a wide variety of qualified medical expenses all tax-free. Any unused earnings rollover from year-to-year. The 2025 annual max contribution is $4,300 for an individual and $8,550 for families. The IRS allows those aged 55+ to contribute an additional ‘catch-up’ amount of $1000. Watch This HSA Video to Learn More

Doctor Visit Visit your healthcare provider and the office will submit the claim to your health plan. Amount Owed The health plan will share the amount you owe with your doctor. EOB The health plan send you the Explanation of Benefits (EOB). Bill Received Your doctor will then send you a bill. HDHP and HSA Consumer Experience Pay with HSA You can use your HSA funds to pay the bill from your doctor.

DENTAL The Principal Dental plan allows a portion of your unused Annual Maximum to carryover to the next year. You must have a dental service in order to qualify for carryover. Principal will issue ID cards to employee’s homes. Dental Coverage with Principal Online Portal

Deductible $50 per covered member, maximum of $150 per family Annual Plan Maximum $1,000 per family member Preventive Services Exams, Cleanings, Fluoride, X-Rays You pay 0% Basic Services Fillings, Extractions, Endodontics, Crown Repairs You pay 20% after deductible Major Services Crowns, Dentures, In/Outlays, Periodontics You pay 50% after deductible Orthodontia Services You pay 50% Orthodontia Lifetime Maximum $1,000 per child In-Network

VISION A list of network providers can be found using the button below. You can choose to use an out of network provider, however your benefits will be in the form of reimbursement rather than fixed copays, and you may pay more out of pocket. You do need to file a claim in order to receive the out of network reimbursement. Delta Vision through the VSP Network Online Portal

Each material benefit is paid out once per calendar year, except for Frames, which are paid out once every two years. Note: VSP does not issue ID cards. Just inform your provider that you have VSP, and they will file your claim accordingly. Exam $20 copay $45 allowance Glasses Lenses (Single / Bifocal/ Trifocal / Lenticular) $20 copay $30 - $100 allowance Glasses Frames $130 retail frame allowance + 20% off remaining balance $70 allowance Contact Lenses (Medically Necessary / Elective) Covered in Full / $130 allowance $210 allowance / $105 allowance In-Network Out-of-Network

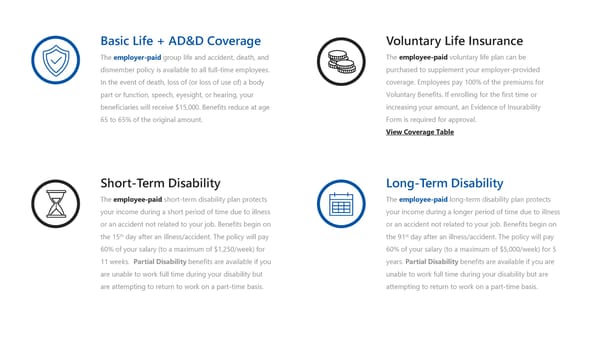

Additional BENEFITS Online Transport provides full-time employees with employer-paid basic life insurance protection at no cost.

Basic Life + AD&D Coverage The employer-paid group life and accident, death, and dismember policy is available to all full-time employees. In the event of death, loss of (or loss of use of) a body part or function, speech, eyesight, or hearing, your beneficiaries will receive $15,000. Benefits reduce at age 65 to 65% of the original amount. Short-Term Disability The employee-paid short-term disability plan protects your income during a short period of time due to illness or an accident not related to your job. Benefits begin on the 15th day after an illness/accident. The policy will pay 60% of your salary (to a maximum of $1,250/week) for 11 weeks. Partial Disability benefits are available if you are unable to work full time during your disability but are attempting to return to work on a part-time basis. Long-Term Disability The employee-paid long-term disability plan protects your income during a longer period of time due to illness or an accident not related to your job. Benefits begin on the 91st day after an illness/accident. The policy will pay 60% of your salary (to a maximum of $5,000/week) for 5 years. Partial Disability benefits are available if you are unable to work full time during your disability but are attempting to return to work on a part-time basis. Voluntary Life Insurance The employee-paid voluntary life plan can be purchased to supplement your employer-provided coverage. Employees pay 100% of the premiums for Voluntary Benefits. If enrolling for the first time or increasing your amount, an Evidence of Insurability Form is required for approval. View Coverage Table

Life can be unpredictable. And it’s not always easy. So, it’s a big deal to know there’s help available when you need it. With an Employee Assistance Program (EAP), you and your family have access to free, confidential resources to help handle life’s everyday—and not so everyday—challenges. Use of the program isn’t reported to your employer. Employee Assistance PROGRAM Get Help Clinical Confidential assistance for a range of concerns including addictions, depression, anxiety, stress, relationships, and parenting. Wellness Telephone based wellness coaching for tobacco cessation, weight loss management, fitness and exercise, stress management, parenting, and relationship support. Work-Life Assistance for daily challenges at home and work including financial, legal, child/elder care, and identity theft. Company Name: Principal Core

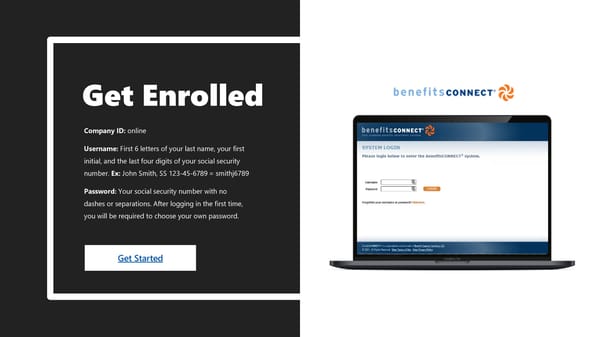

Get Enrolled Company ID: online Username: First 6 letters of your last name, your first initial, and the last four digits of your social security number. Ex: John Smith, SS 123-45-6789 = smithj6789 Password: Your social security number with no dashes or separations. After logging in the first time, you will be required to choose your own password. Get Started